Your Home Equity Could Be the Most Affordable Cash You Ever Access.

If you’ve owned your home for a few years, chances are you’ve built some serious equity—especially with rising property values. A conventional cash-out refinance lets you access that equity and put it to work for you.

Whether you’re paying off debt, investing, renovating, or funding college tuition, this guide will walk you through how a cash-out refinance works and help you calculate exactly how much cash you could walk away with.

What Is a Cash-Out Refinance?

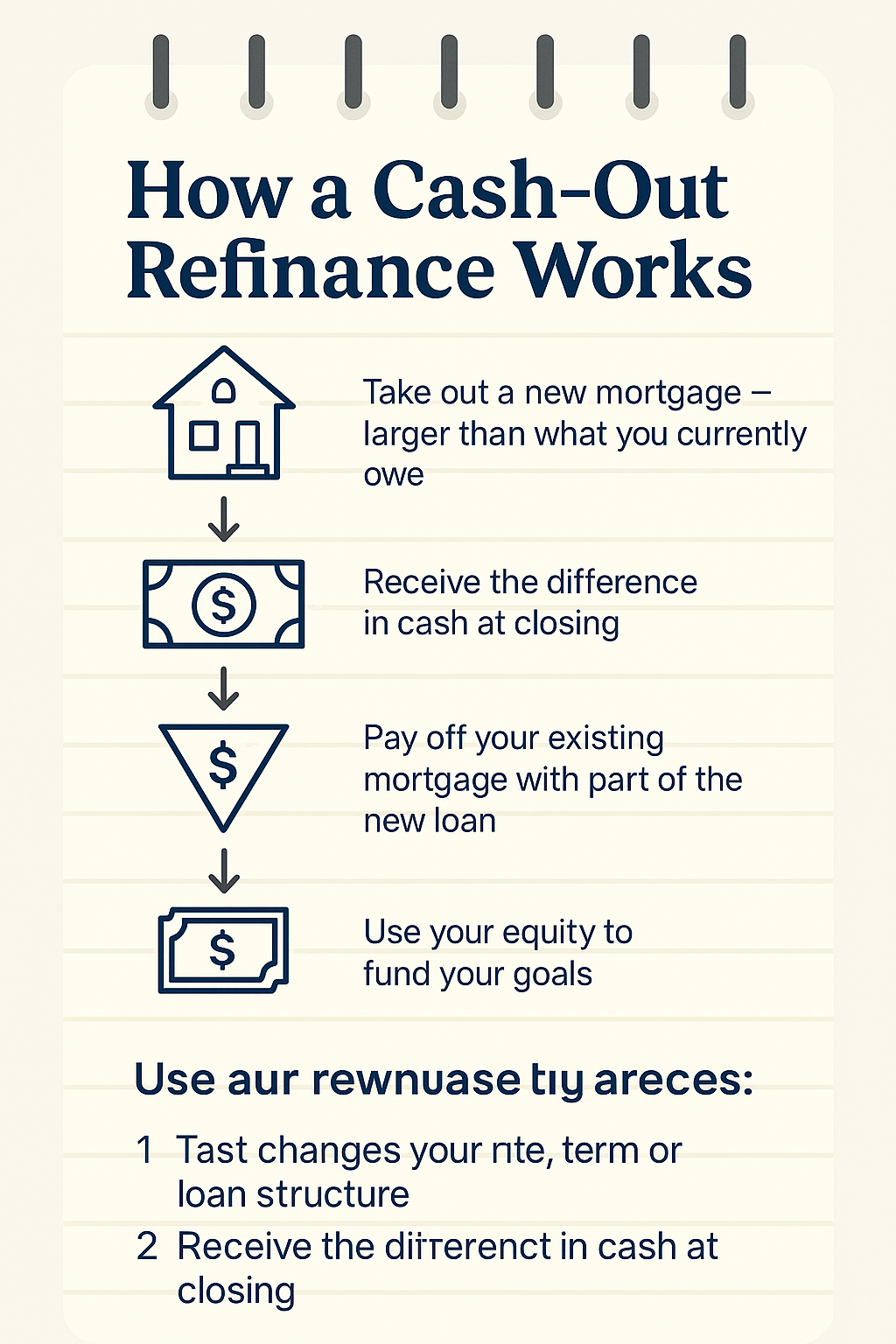

A cash-out refinance replaces your existing mortgage with a larger one—and pays you the difference in cash. It’s not a second mortgage or a home equity line of credit (HELOC); it’s one simple loan, fully underwritten and funded at closing.

Why People Use Cash-Out Refinancing:

- Pay off high-interest credit cards or personal loans

- Fund home renovations or additions

- Invest in real estate or a business

- Cover education or medical expenses

Replace aging HVAC, roofs, or windows with higher efficiency upgrades

What Are the Guidelines for Cash-Out Refinancing?

To qualify for a conventional cash-out refinance, you’ll typically need:

- Credit Score: 640+ (better scores = better rates)

- Loan-to-Value (LTV): Max 80% of your home’s current appraised value

- Occupancy: Primary, second home, or investment properties

- Seasoning: Usually 6–12 months since you purchased or last refinanced

- DTI: Under 45% in most cases

Not sure your income is a perfect fit? Explore No-Doc or Bank Statement Loans.

How Much Cash Can I Get?

You can typically borrow up to 80% of your home’s appraised value, minus what you still owe.

Example:

- Home Value: $500,000

- Max 80% LTV = $400,000

- Current Loan Balance = $310,000

- Estimated Cash-Out = $90,000

Use our calculator above to run your own numbers in real-time.

When Is a Cash-Out Refinance a Good Idea?

You may benefit from a cash-out refinance if:

- You’re carrying high-interest debt and want to consolidate

- You’re planning a major renovation or expansion

- You want capital for investing or buying another property

You’re paying for a large one-time expense like education or a wedding

When Is a Conventional Loan the Best Fit?

This loan works well if you:

- Have solid credit and steady income

- Can put 3–20% down

- Want to build equity and eliminate PMI

- Are buying a second home or rental

Plan to stay in the home for 5+ years

Final Thoughts: Your Equity Is Idle Cash—Put It to Work.

A conventional cash-out refinance gives you power: the power to reduce debt, build value, or invest in your future—all without selling your home. You’ve built this equity. Let’s use it wisely.

Book a Free Equity Planning Call

We’ll help you structure it for financial growth—not just convenience.

Ready to Take Your First Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact