How Does Mortgage Leverage Build Wealth?

- By Jim Blackburn

- on

- purchase, real estate investing, vision board, wealth plan

For most Americans, a mortgage isn’t just a way to buy a home — it’s the most powerful financial tool they’ll ever use.

But here’s what most people never realize:

The wealth is in the leverage.

When used wisely, a mortgage gives you access to something far more valuable than a house — it gives you ownership, equity growth, and scalable wealth potential that renting can never provide.

Let’s break it down.

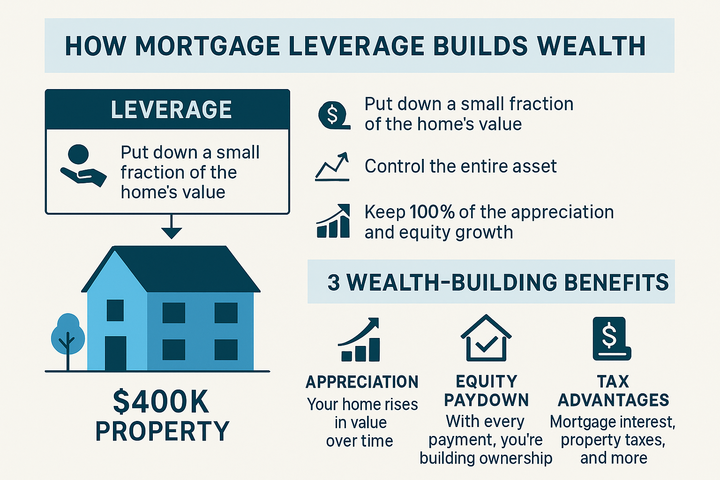

What Is Leverage in Real Estate?

In simple terms, leverage means using other people’s money to control an asset that grows in value.

When you take out a mortgage, you’re using the bank’s capital (usually 75–97% of the purchase price) to own 100% of the property.

You:

- Put down a small fraction of the home’s value

- Control the entire asset

- Keep 100% of the appreciation and equity growth

That’s leverage.

Start building wealth through leverage with low down payment options like our FHA Purchase Loan (3.5% down) or Conventional Purchase Loan (3% down for first-time buyers).

Example: $400K Property, 5% Down

- Your down payment: $20,000

- Loan amount (mortgage): $380,000

- Home appreciates 5% in Year 1: New value = $420,000

You just gained $20,000 in equity — a 100% return on your down payment — even though you only “owned” 5% of the property at the start.

Now imagine that over 5–10 years, with debt being paid down and the home continuing to grow in value.

See how leverage multiplies returns with our Buy and Hold Real Estate calculator to understand appreciation, equity growth, and cash flow over time.

Why This Beats Saving Alone

If you save $20,000 in a bank account, it might grow at 3–5% annually.

In real estate, $20K can control a $400K asset — and that asset can grow in value, generate tax advantages, and eventually become income-producing.

That’s the beauty of mortgage leverage:

You can grow wealth faster without having to save hundreds of thousands first.

Explore how strategic leverage accelerates wealth building with the BRRRR Method to see how buy, rehab, rent, refinance, and repeat strategies compound your results.

3 Wealth-Building Benefits of a Mortgage

- Appreciation

Your home rises in value over time — and you keep all the upside. - Equity Paydown

With every payment, you’re building ownership — not just covering rent. - Tax Advantages

Mortgage interest, property taxes, and even depreciation (on rentals) can reduce your taxable income.

Bonus: When you refinance or use a HELOC, you can tap into equity without selling.

Access your equity strategically with our Conventional Cash-Out Refinance or HELOC Loan Payment Calculator to leverage existing properties for additional investments.

But Only If You Use It Wisely…

Leverage can also magnify losses if used recklessly.

So we always ask:

- Is your payment sustainable long-term?

- Are you buying in a smart location?

- Is this step part of a bigger plan?

We help you answer those questions — and use leverage as a launchpad, not a trap.

Map your complete wealth strategy with our Legacy Impact Planner to ensure every leveraged purchase moves you toward your long-term goals.

Want to Use Mortgage Leverage to Build Real Wealth?

Smart leverage turns small down payments into substantial wealth. Here’s how to get started:

🏡 Start with low down payment options using our FHA Purchase Loan or Conventional Purchase Loan calculators

📊 Learn wealth-building strategies with our Buy and Hold Real Estate calculator

🔄 Scale faster with the BRRRR Method to see how strategic refinancing multiplies your portfolio

💰 Leverage existing equity with our Conventional Cash-Out Refinance calculator to fund your next investment

Ready to Take Your First Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Let’s talk it through. Book a call and one of our friendly advisors will be in touch to guide you personally.

Schedule a Call