Interest-Only Loans | Pay Interest Only for 5–10 Years to Maximize Cash Flow

An interest-only mortgage gives you the option to pay just the interest for the first several years of your loan term—typically five, seven, or ten years. During this time, your monthly payments are significantly lower than they would be with a fully amortizing loan.

That freed-up cash can be reinvested into your business, used to purchase another property, or kept in reserves for liquidity and peace of mind.

This loan isn’t for everyone—but for the right buyer, it’s a strategic tool.

How Interest-Only Loans Work

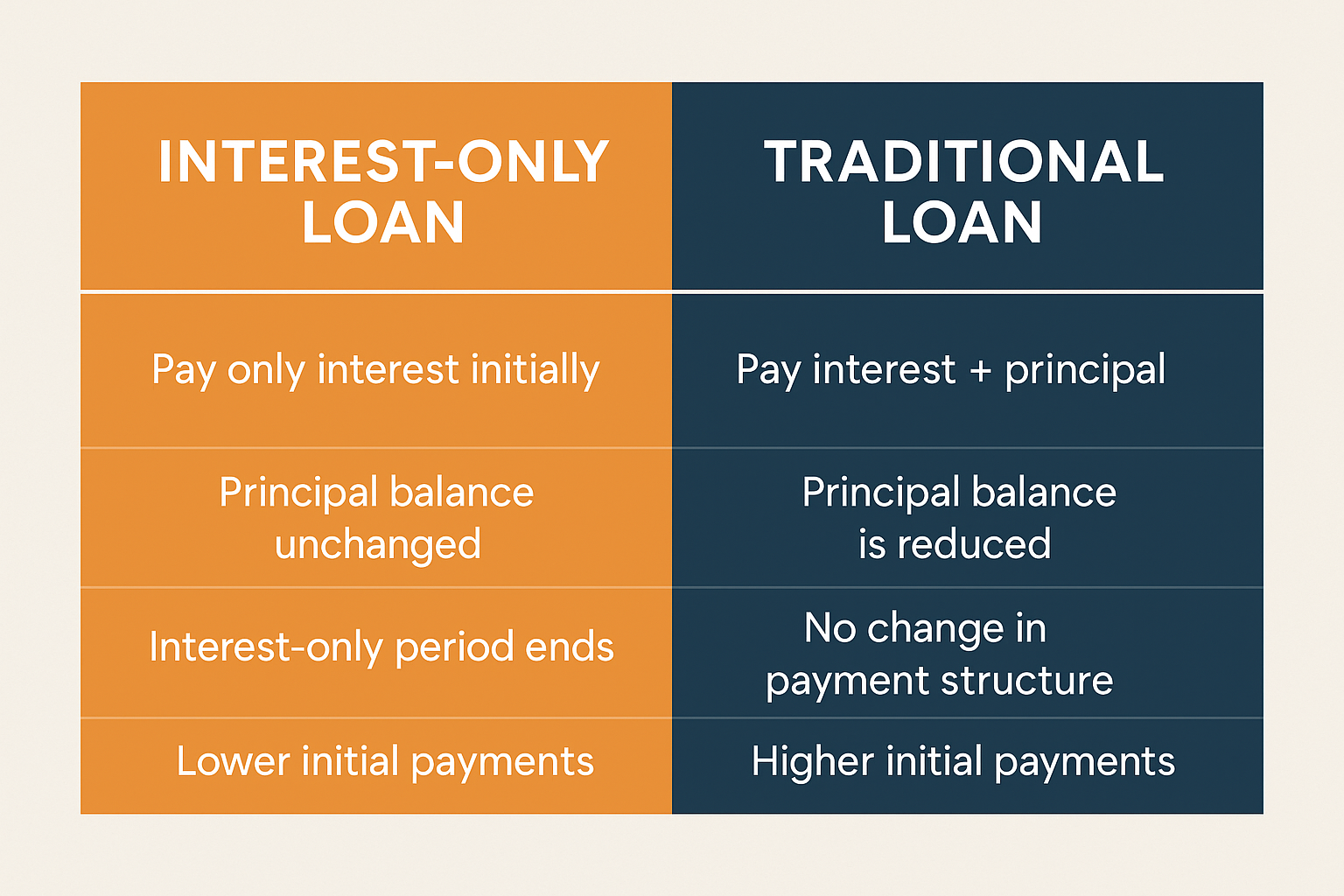

During the interest-only period:

- You pay only the interest on the loan.

- Your principal balance remains the same.

- After the initial term ends, your loan converts to a traditional principal-and-interest loan.

You can refinance or sell before that happens—or continue with the full amortized payment schedule.

Who It’s For

Interest-only loans are typically used by:

- High-income earners who prefer liquidity

- Real estate investors maximizing leverage

- Buyers who plan to refinance or sell before the interest-only term ends

- Business owners with fluctuating income who want payment flexibility

This is not ideal for buyers planning to hold long-term with limited financial reserves.

The Strategy Behind the Loan

This loan isn’t about affordability. It’s about control.

By minimizing your required monthly outlay, you’re preserving capital. That might mean you can:

- Invest in another property

- Build a cash cushion

- Allocate funds to a business or growth vehicle

Qualify for a higher purchase price due to lower payments

Key Considerations

- Minimum 15–20% down

- Typically available for credit scores of 680+

- Most lenders require strong income or significant liquid assets

- Not all lenders offer this—many are through portfolio or non-QM channels

Ready to Take Your First Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- 💡 Takes just 5 minutes

- 📊 Tailored results based on your answers

- 🔒 No credit check required

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- 💡 Only 2 minutes to complete

- 📊 Quick turnaround on pre-approval

- 🔒 No credit score impact