How to Use a Reverse Mortgage for Aging in Place (Without Compromise)?

- By Jim Blackburn

- on

- purchase, real estate investing, reverse mortgage, vision board, wealth plan

You’ve worked hard to build a home — filled with memories, routines, and people you love.

So when it comes time to think about retirement and long-term care, moving into a facility may feel like a compromise you’re not ready to make.

The good news? You don’t have to.

With a reverse mortgage, you can unlock the equity in your home to stay right where you are — safely, comfortably, and with the financial support you need.

What Does “Aging in Place” Really Mean?

Aging in place means staying in your home as you grow older — rather than moving to a retirement community or assisted living facility.

It’s about:

- Maintaining independence

- Preserving comfort and routine

- Avoiding disruptive transitions

- Living with dignity — on your terms

But to age in place safely, you need resources. That’s where a reverse mortgage comes in.

Explore how a reverse mortgage can support your independence with our Reverse Mortgage Income for Life calculator to see what monthly income you could receive to cover care and living expenses.

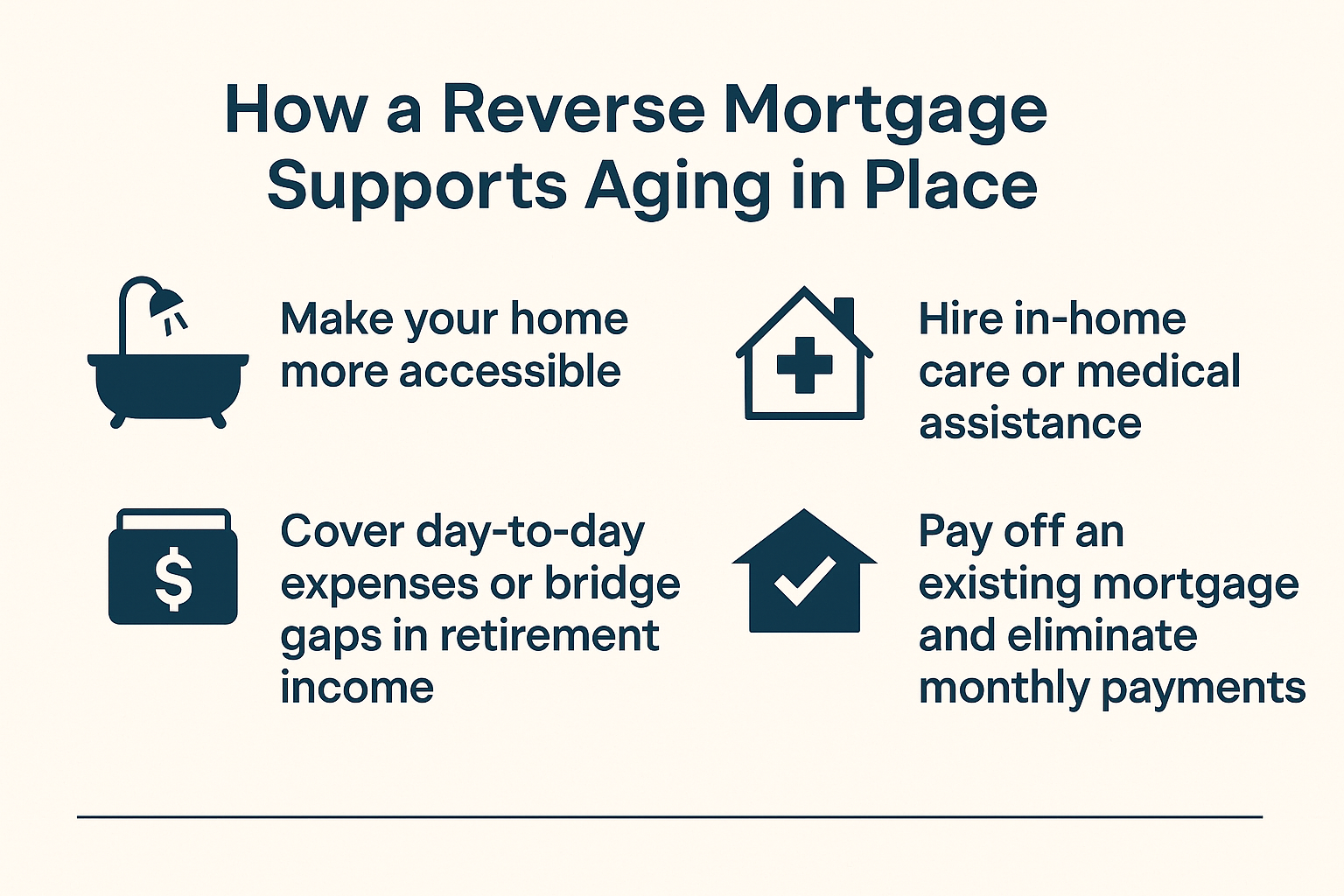

How a Reverse Mortgage Supports Aging in Place

A reverse mortgage gives you access to a portion of your home’s equity — in the form of tax-free cash — without requiring monthly mortgage payments.

You can use that money to:

- Make your home more accessible (e.g., bathroom renovations, ramps, stair lifts)

- Hire in-home care or medical assistance

- Cover day-to-day expenses or bridge gaps in retirement income

- Pay off an existing mortgage and eliminate monthly payments

- Set aside an emergency fund to reduce stress on family members

Best of all? You stay in your home.

Use our Reverse Mortgage Cash-Out Refinance calculator to see how much you could access for home modifications, in-home care, or to eliminate your current mortgage payment entirely.

Worried About Outliving the Loan?

Don’t be.

Reverse mortgages don’t expire as long as:

- You live in the home as your primary residence

- You keep up with property taxes, insurance, and basic maintenance

You can stay as long as you like — with no monthly mortgage payments.

Calculate your options with our reverse mortgage calculators to understand exactly how the loan works over time and what it means for your long-term security.

What Happens When You’re Gone or Move Out?

When you pass away or move permanently (e.g., into full-time care), the loan is repaid — usually through the sale of the home.

Anything left over goes to your heirs or estate.

If the home sells for less than the loan balance, your heirs won’t owe the difference. That’s the non-recourse protection that comes with FHA-backed reverse mortgages.

Show your family what to expect with our Reverse Mortgage Legacy Inheritance Estimator to see what equity could remain for your heirs under different scenarios.

Who This Works Best For

Aging in place with a reverse mortgage works best if:

- You plan to stay in your home for the long term

- You have significant home equity

- You want more financial breathing room without selling or downsizing

- You want to maintain privacy, comfort, and control

Before making any decisions, explore all your reverse mortgage options at our reverse mortgage journey page to see which structure best supports your aging-in-place goals.

Want to Stay in Your Home on Your Terms?

Aging in place doesn’t mean doing it alone or struggling financially. Here’s how a reverse mortgage can support your independence:

💰 Use the Reverse Mortgage Cash-Out Refinance calculator to see how much you can access for home modifications and care

📈 Explore the Reverse Mortgage Income for Life calculator to create predictable monthly income for ongoing expenses

👨👩👧👦 Share the Reverse Mortgage Legacy Inheritance Estimator with your family to show what equity could remain for them

🏡 Review all aging-in-place options at our reverse mortgage journey page to find the right solution for your situation

Ready to Take Your First Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Let’s talk it through. Book a call and one of our friendly advisors will be in touch to guide you personally.

Schedule a Call