How Can I Pay Off My Home Faster?

- By Jim Blackburn

- on

- heloc, home equity, purchase, real estate investing, refinance, vision board, wealth plan

How Can I Pay Off My Home Faster?

You’ve built equity. You’ve got momentum.

Now you’re asking a powerful question:

“How can I get out of this mortgage sooner?”

Good news — we’ve helped hundreds of homeowners shorten their loan terms, save tens of thousands in interest, and move one step closer to financial freedom.

Here’s how.

Step 1: Refinance to a Shorter Term

The most direct route to faster payoff is choosing a shorter mortgage:

- From 30 to 20 years

- From 30 to 15 years

- Or even 10 years (yes, it’s possible)

What changes:

- Your interest rate often drops

- You build equity much faster

- You can save tens of thousands over the life of the loan

Yes, the payment may increase slightly — but we’ll help you assess if the numbers make sense based on your goals.

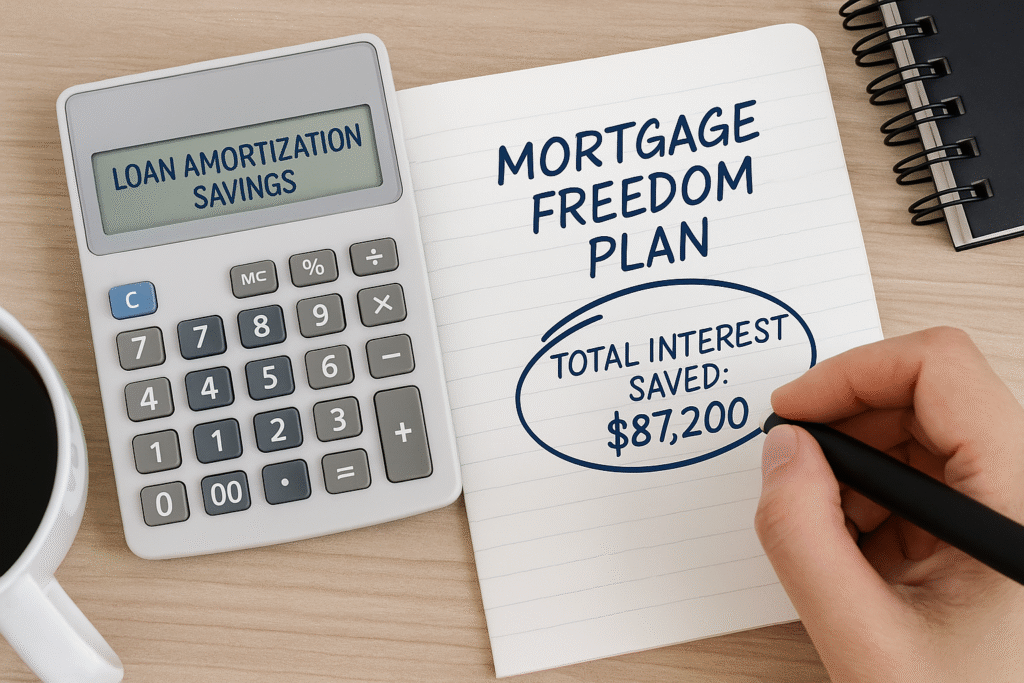

See payment differences and total interest savings by comparing loan terms with the Conventional Refinance calculator, or check streamlined options using the FHA Streamline Refinance calculator.

Step 2: Keep Your Current Term — Pay Extra Strategically

If you want the flexibility of a 30-year loan but still want to pay it down faster, we can:

- Show you how to apply extra payments toward principal

- Run amortization charts so you see exactly how much faster you’ll pay it off

- Recommend timing strategies (monthly, bi-weekly, lump sum)

Even small overpayments make a huge difference over time.

Visualize your accelerated payoff timeline by running scenarios through the Compare 2 Rates calculator to understand how extra payments impact your loan.

Step 3: Combine with Debt Elimination or Investment Strategy

Some homeowners choose to:

- Pay off high-interest debt first, then accelerate mortgage payoff

- Refi into a smarter loan, then redirect savings into investments with higher returns

It’s not always about just paying off the house. It’s about knowing your numbers — and choosing the right wealth strategy.

We’ll run the projections with you and help you decide what’s best.

Evaluate debt consolidation options with the Conventional Cash-Out Refinance calculator to eliminate high-interest debt before accelerating mortgage payoff.

Want Financial Freedom Through Strategic Mortgage Payoff?

Your 30-year loan isn’t permanent—whether you want faster payoff, lower payments, or strategic debt elimination, we’ll design a refinancing path that serves your

📊 Plan your complete wealth strategy with the Legacy Impact Planner calculator to see if early payoff serves your goals

🏘️ Learn alternative wealth-building approaches using the Buy and Hold Real Estate calculator

💼 Work with strategic advisors through our financial planners network

🔄 Discover investment scaling strategies with the BRRRR Method calculator

Ready to Take Your First Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Let’s talk it through. Book a call and one of our friendly advisors will be in touch to guide you personally.

Schedule a Call