Divorce and Mortgage | Refinance to Keep the Home or Get Pre-Approved to Start Fresh

Divorce is tough—emotionally, financially, and logistically. But one thing is certain: you don’t have to give up your homeownership goals. Whether you’re trying to keep the home, buy out your ex, or start fresh, we’ll help you plan the right mortgage strategy to protect your credit, stability, and future.

What Happens to the Mortgage During Divorce?

You have a few options:

- Refinance to Keep the Home – One spouse refinances the loan in their name alone and buys out the other’s equity.

- Sell the Home and Split Proceeds – Clean break, with both moving on.

- Continue Co-Owning Temporarily – Not ideal long-term, but sometimes needed during transition.

Each choice has legal, tax, and emotional factors—talk to a lender and your attorney before deciding.

How to Refinance After Divorce

If you want to keep the home:

- Get approved based on your solo income and credit

- Refinance the loan into your name only

- Use equity (or additional funds) to buy out your ex’s share

We’ll help you:

- Run the numbers

- Estimate the buyout amount

Plan the best timing based on divorce proceedings

What If You Want to Start Over?

A clean slate might be the best move.

If you’re starting fresh:

- We can pre-approve you for a new home purchase loan

- Use your share of the proceeds as your down payment

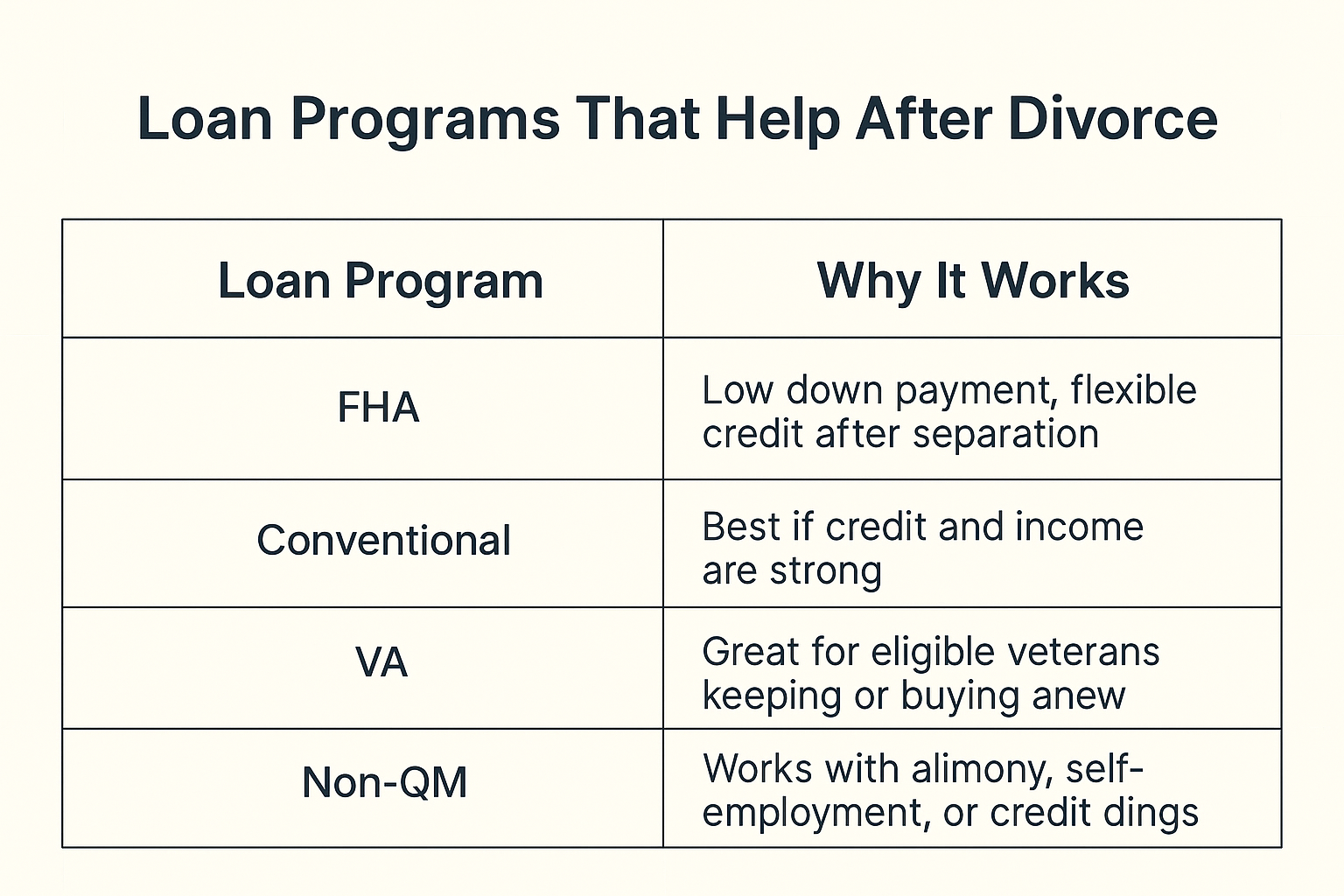

- Explore low down payment options and soft credit programs

Divorce doesn’t have to be the end of your homeownership story—it can be the start of a better one.

Credit Tip: Don’t Stop Paying the Mortgage

Even if you’ve moved out, keep paying your share until the loan is refinanced or the house is sold. Missed payments hurt both parties.

Final Word: A New Chapter Starts Here

You deserve peace of mind, a solid plan, and a place to call your own. We’ll help you navigate the numbers, the paperwork, and the emotions with clarity and confidence.

Book Your Divorce Mortgage Planning Session Now

Ready to Take Your First Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- 💡 Takes just 5 minutes

- 📊 Tailored results based on your answers

- 🔒 No credit check required

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- 💡 Only 2 minutes to complete

- 📊 Quick turnaround on pre-approval

- 🔒 No credit score impact