Common Reverse Mortgage Myths — Debunked with Real Facts

- By Jim Blackburn

- on

- purchase, real estate investing, reverse mortgage, vision board, wealth plan

Reverse mortgages have helped millions of older homeowners enjoy retirement with more freedom, less stress, and greater financial control.

And yet… there’s still a lot of confusion out there.

Let’s clear the air. These are the most common myths we hear — and the facts that help set the record straight.

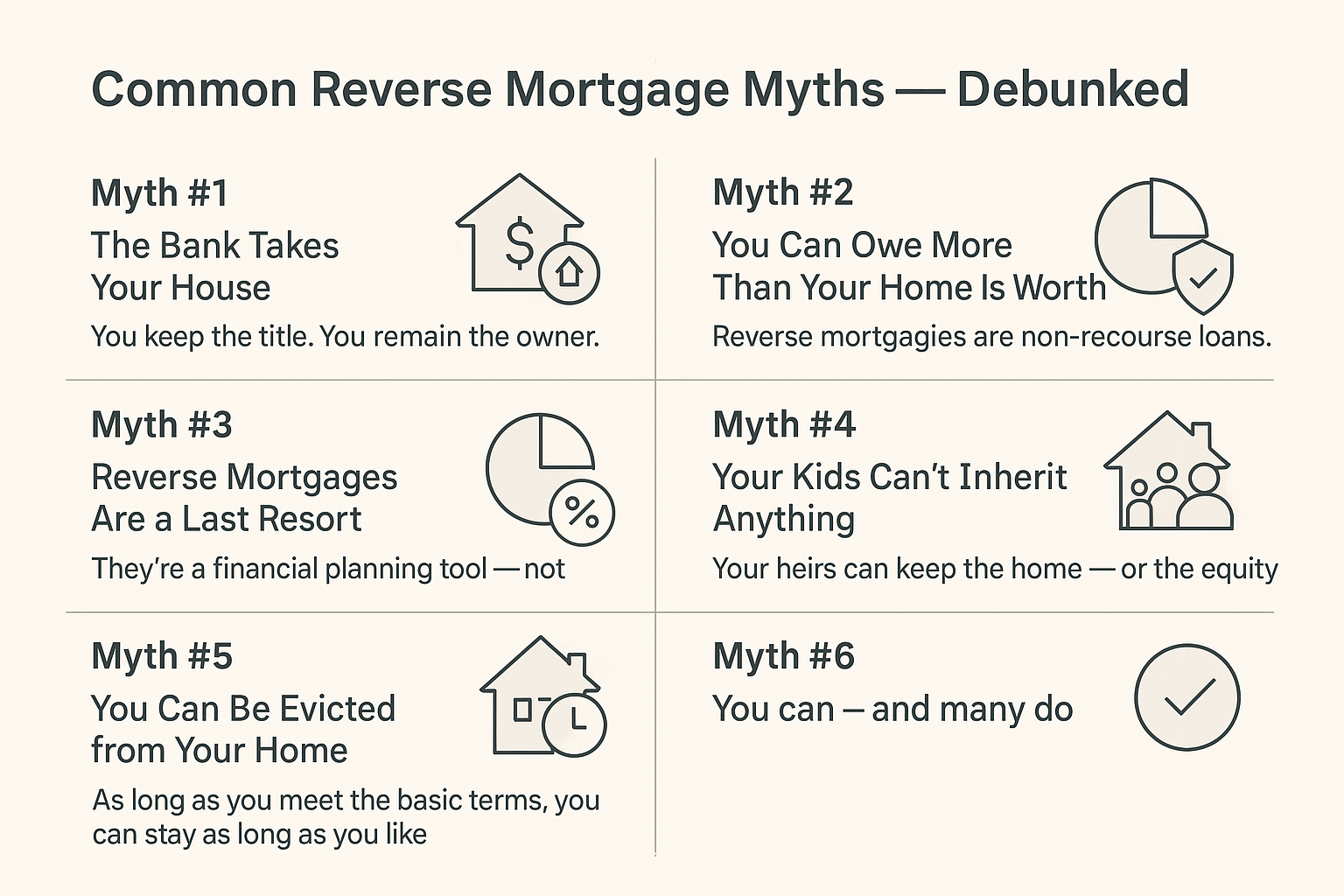

Myth #1: The Bank Takes Your House

Reality: You keep the title. You remain the owner.

A reverse mortgage is a loan — not a transfer of ownership. Just like a traditional mortgage, you still own the home, control decisions, and retain the right to sell or refinance.

The loan becomes repayable only when you move out, sell, or pass away.

Want to understand how reverse mortgages really work? Our Reverse Mortgage calculators break down the facts and show you exactly how ownership, equity, and repayment work.

Myth #2: You Can Owe More Than Your Home Is Worth

Reality: Reverse mortgages are non-recourse loans.

That means you’ll never owe more than the home is worth — even if property values drop. If the loan balance ever exceeds the home’s value, FHA insurance covers the difference. Neither you nor your heirs will be responsible for the shortfall.

See how non-recourse protection works with our Reverse Mortgage Legacy Inheritance Estimator to understand what equity could remain for your heirs under different scenarios.

Myth #3: Reverse Mortgages Are a Last Resort

Reality: They’re a financial planning tool — not a bailout.

In fact, more financial advisors are recommending reverse mortgages as part of a proactive retirement strategy. They’re used to reduce risk, increase flexibility, and protect other assets — not just to survive.

Explore proactive strategies like the Reverse Mortgage Income for Life calculator to see how reverse mortgages create steady monthly income as part of a comprehensive retirement plan.

Myth #4: Your Kids Can’t Inherit Anything

Reality: Your heirs can keep the home — or the equity.

When the loan ends, your family can:

- Refinance the balance and keep the home

- Sell it and keep the remaining proceeds

- Or walk away if the loan exceeds the home’s value (with no financial penalty)

You can even involve your children in the planning process from day one.

Show your family the numbers with our Reverse Mortgage Legacy Inheritance Estimator to demonstrate how much equity could remain for inheritance over time.

Myth #5: You Can Be Evicted from Your Home

Reality: As long as you meet the basic terms, you can stay as long as you like.

You’re simply responsible for:

- Paying property taxes

- Keeping up homeowners insurance

- Maintaining the home in reasonable condition

- Living there as your primary residence

These are the same responsibilities any homeowner has — reverse mortgage or not.

Myth #6: You Can’t Get a Reverse Mortgage If You Have a Mortgage

Reality: You can — and many do.

In fact, paying off an existing mortgage is one of the most common reasons people get a reverse mortgage. The reverse loan wipes out your monthly mortgage payment, freeing up cash for other needs.

Calculate how much you could access with a Reverse Mortgage Cash-Out Refinance to eliminate your current mortgage payment and free up monthly cash flow.

Myth #7: It’s Too Complicated

Reality: It’s simpler than most people think — when you have the right guide.

Yes, reverse mortgages have rules — and they should. But when you work with a trusted, experienced team, you’ll get:

- Clear answers

- Easy-to-understand options

- A no-pressure environment focused on you

Start with our easy-to-use Reverse Mortgage calculators to explore your options at your own pace before having any conversations—no pressure, just clarity.

Want the Real Facts About Reverse Mortgages?

Don’t let misconceptions keep you from exploring one of retirement’s most powerful financial tools.

Want the Real Facts About Reverse Mortgages?

Here’s where to start:

💰 Use the Reverse Mortgage Cash-Out Refinance calculator to see how you can eliminate your monthly mortgage payment and access cash

📈 Explore the Reverse Mortgage Income for Life calculator to create predictable monthly income from your home equity

👨👩👧👦 Show your family the Reverse Mortgage Legacy Inheritance Estimator to see how much equity could remain for your heirs

🏡 Consider a Reverse Mortgage Home Purchase Loan to right-size your home without monthly payments

Ready to Take Your First Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Let’s talk it through. Book a call and one of our friendly advisors will be in touch to guide you personally.

Schedule a Call