College Student Housing Investment Strategy

What If You Could Graduate With Equity Instead of Student Loan Debt?

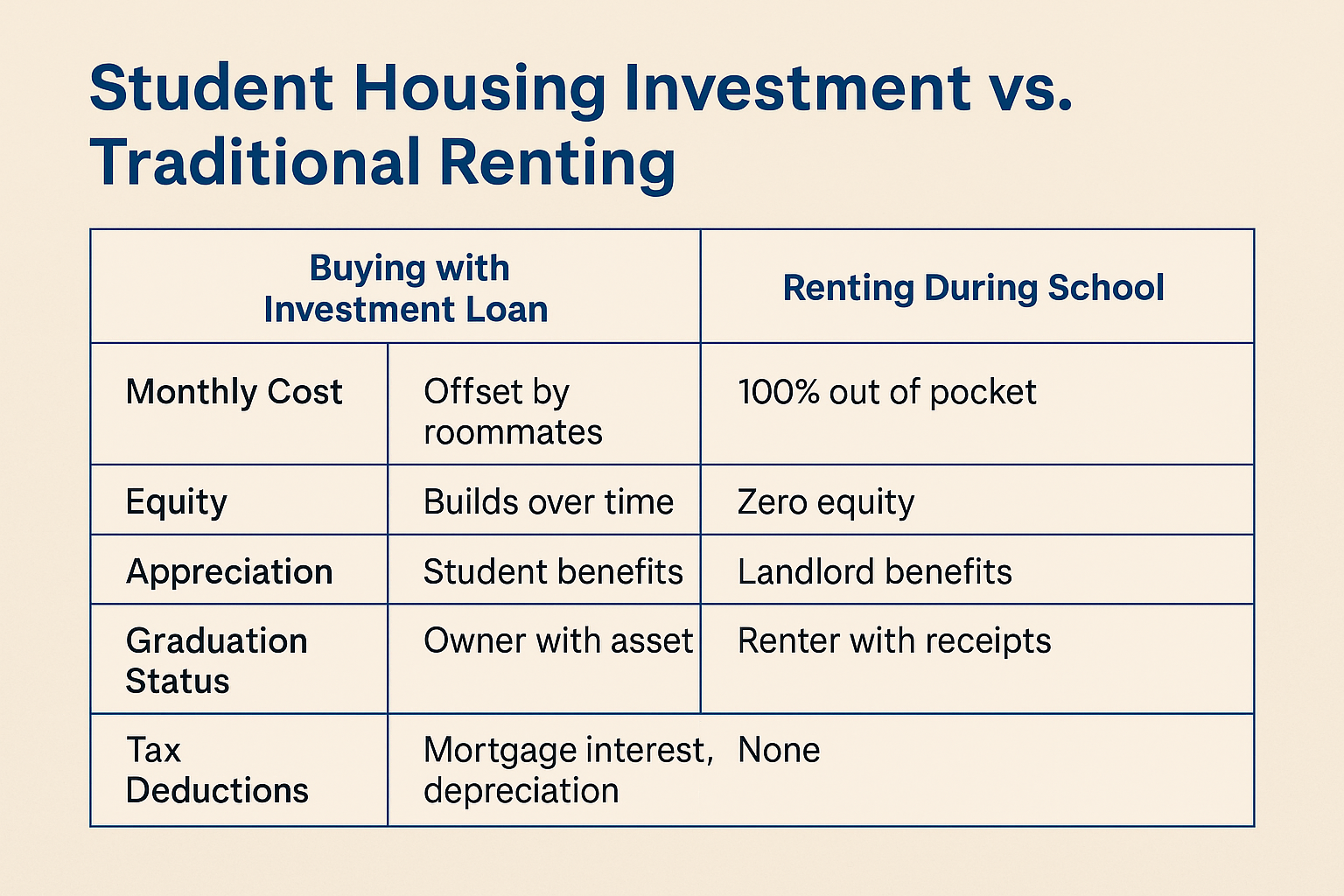

College used to be all about education and debt. But a new wave of young adults is using a smarter strategy: buying real estate as a student. With the right housing investment loan, you can purchase a home or multi-unit property, live in part of it, and rent the rest to roommates—offsetting your mortgage or even turning a profit.

This is how smart students are graduating with wealth instead of just a degree.

What Is a College Student Housing Investment Loan?

This isn’t an official loan type—it’s a strategy. It means using owner-occupied mortgage programs designed for first-time buyers (or co-buyers with parents) to purchase a home while enrolled in college.

Common Programs:

- FHA Loan (3.5% down)

- Conventional First-Time Buyer Loan (3% down)

- Co-Signed Conventional Loan with Parent

- DSCR Loan (for parents or investors buying near campus)

- Bank Statement Loans (for self-employed or freelance students)

The key is that you (or your co-buyer) live in the home as your primary residence to access the best rates and down payment options.

How Students Are Using These Loans

- Buy a 3-bedroom condo or home near campus, live in one room, and rent out the others

- Co-buy with a parent, split costs and equity

- Purchase a duplex or triplex using FHA or Conventional (must live in one unit)

- Use scholarships, grants, or part-time income to qualify (with co-signer if needed)

- Build equity while your friends are spending rent money

Who It’s For

This loan strategy works for:

- College or grad students with income or co-signer

- Parents investing in student housing for their children

- Students with part-time jobs or 1099 work

- First-generation buyers looking to build long-term wealth

- Real estate-minded students who want a head start on their portfolio

Key Requirements

- Down Payment: 3%–5% (can be gifted)

- Credit Score: 620+ (co-signer can boost approval)

- Income: W-2, 1099, or bank statements accepted (with flexible programs)

- Occupancy: Student must live in the home as primary residence

- Loan Limits: Based on local FHA/conventional limits and school location

We’ll help you structure this with or without a parent on the loan.

Final Word: Real Estate Could Be Your Smartest Course

You don’t need a 6-figure income or perfect credit to become a homeowner while in school. You just need a smart loan strategy, a trusted guide—and a little bit of hustle. Let’s make this your first real estate win.

Book Your College Housing Investment Strategy Call Now

Ready to Take Your First Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- 💡 Takes just 5 minutes

- 📊 Tailored results based on your answers

- 🔒 No credit check required

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- 💡 Only 2 minutes to complete

- 📊 Quick turnaround on pre-approval

- 🔒 No credit score impact