How a $32 Life Insurance Policy Protected a $475K Mortgage

- By Jim Blackburn

- on

Client Profile:

- Names: Michelle & Darren

- Ages: 58 & 61

- Occupations: Retired teacher and small business owner

- Goal: Make sure their rental properties passed to their kids without legal delays

- Location: Sacramento, CA

The Situation

Michelle and Darren owned 3 properties:

- Their primary residence

- A duplex rental

- A paid-off condo in Arizona

They had wills but hadn’t taken the time to create a living trust. After hearing a friend’s horror story of losing a property to probate complications, they contacted us for help.

We walked them through what would happen if one of them passed unexpectedly without a trust — and it was a wake-up call.

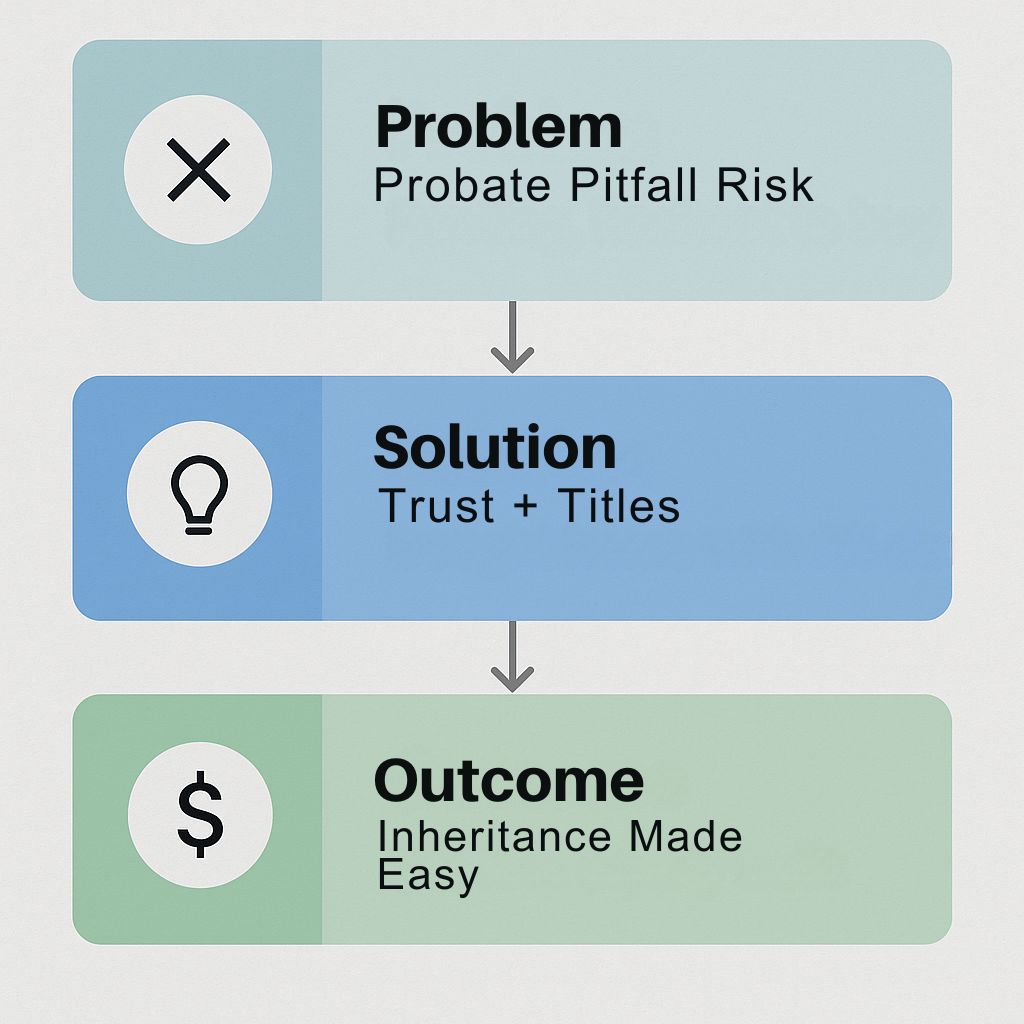

The Risk Without a Trust

Without a living trust:

- Each property would go through probate (which can take 9–18 months)

- Their children would need to hire attorneys and petition the court

- Their rental income could be frozen during the process

- Assets could be subject to unnecessary taxes, delays, and disputes

They realized they’d built wealth… but hadn’t protected it.

The Strategy

With an estate attorney, we helped them:

- Create a revocable living trust

- Title all three properties into the trust

- Name each other as successor trustee, then their daughter

- Include instructions for selling, renting, or gifting each property

- Add durable power of attorney and medical directives

The Results

- Peace of mind knowing everything is in order

- Rental income would continue uninterrupted

- No probate required for any real estate

- Their kids will inherit directly, with no courts involved

- Updated their life insurance and 401(k) beneficiaries to align with trust

What Michelle Said

“We thought a will was enough. But this trust guarantees our kids won’t have to deal with red tape and confusion during an already hard time. That’s priceless.”

Takeaway for Readers

If you own real estate — especially rentals — a living trust isn’t a luxury. It’s a necessity. It’s the difference between your family inheriting a gift… or a mess.

Ready to Take Your First Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact