- By Jim Blackburn

- on

- first time home buyer, first time investor, investor mindset, real estate investing

Client Profile:

- Name: James

- Age: 38

- Occupation (Then): Corporate project manager

- Goal: Build a real estate income stream big enough to replace his W-2 job

- Location: Indianapolis, IN

The Situation

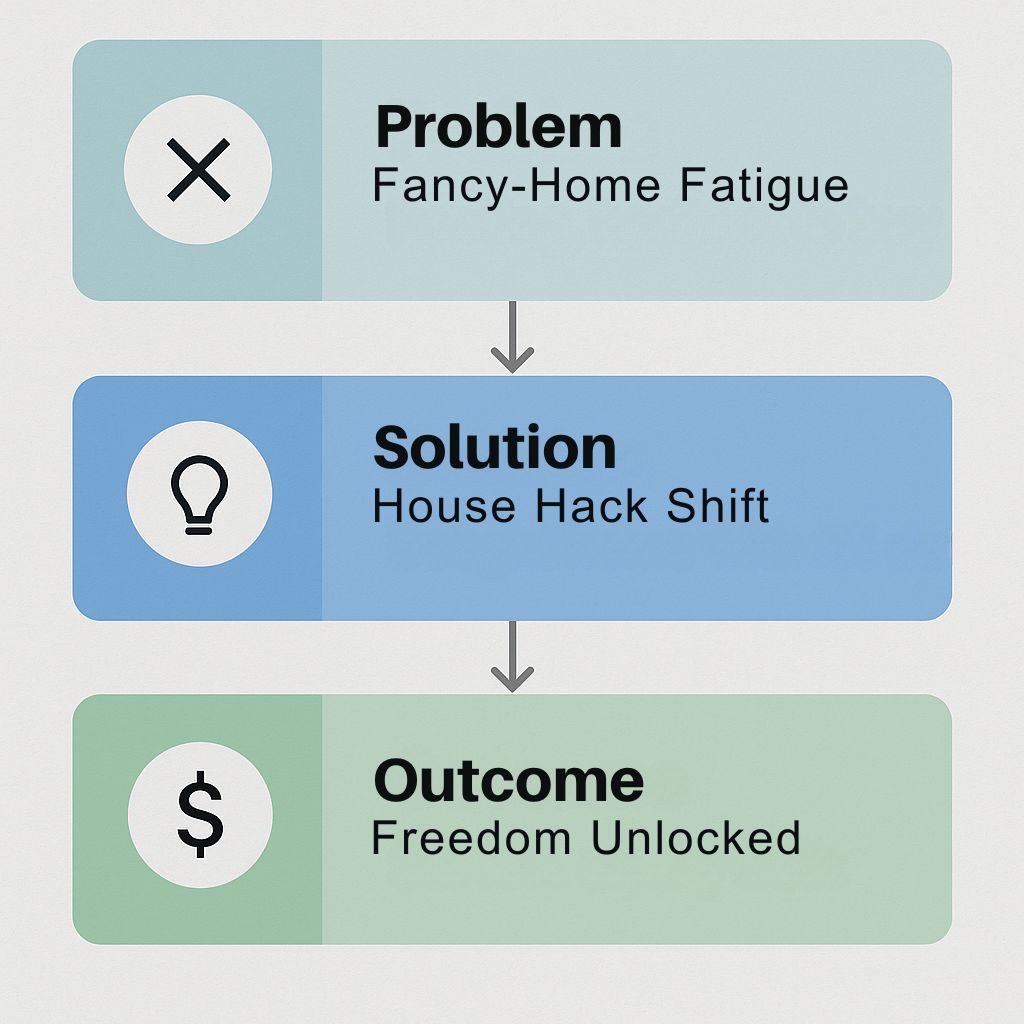

James had owned a beautiful single-family home for 7 years and was shopping for a “forever home” in a fancier neighborhood. But he wasn’t fulfilled at work, and his long-term dream was freedom, not a formal dining room.

After taking our Homeowner vs. Investor Identity Quiz, he had an epiphany:

“I’ve been buying for status, not strategy. I want cash flow, not countertops.”

The Shift

Instead of upgrading his personal residence, James:

- Sold his SFR at a $78K profit

- Used the proceeds to buy a 4-unit multifamily in a working-class neighborhood

- Lived in one unit and rented the other three

- Switched his focus from luxury to leverage

The Numbers

Property | Value |

Purchase Price (4-unit) | $412,000 |

Down Payment (1031 Exchange funds) | $82,000 |

Gross Monthly Rent (3 units) | $3,525 |

PITI (incl. escrow + mgmt) | $2,240 |

Net Monthly Cash Flow | ~$1,285 |

James’s Unit: | Rent-free (effectively) |

The Results (24 Months Later)

- Acquired a second duplex using saved cash flow + HELOC

- Replaced over $42K/year of his previous salary

- Quit his job and now teaches others how to do the same

- Says his life is simpler, but far more fulfilling

What James Said

“Once I stopped buying homes for comfort and started buying them for cash flow, my whole life changed. I didn’t want granite. I wanted freedom.”

Takeaway for Readers

Mindset determines your path. A homeowner builds stability. An investor builds systems. You can be both — but knowing which one is driving your decision changes everything.

Ready to Take Your First Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact