How a First-Time Buyer Used a Conventional Loan to Buy a Townhome with Just 3% Down

- By Jim Blackburn

- on

Client Profile

- Name: Emily R.

- Age: 28

- Profession: Graphic Designer

- Location: Raleigh, NC

- Income: $68,000/year

- Credit Score: 720

- Loan Type: Conventional 97 (First-Time Buyer Program)

- Down Payment: 3% ($8,700 on a $290,000 purchase)

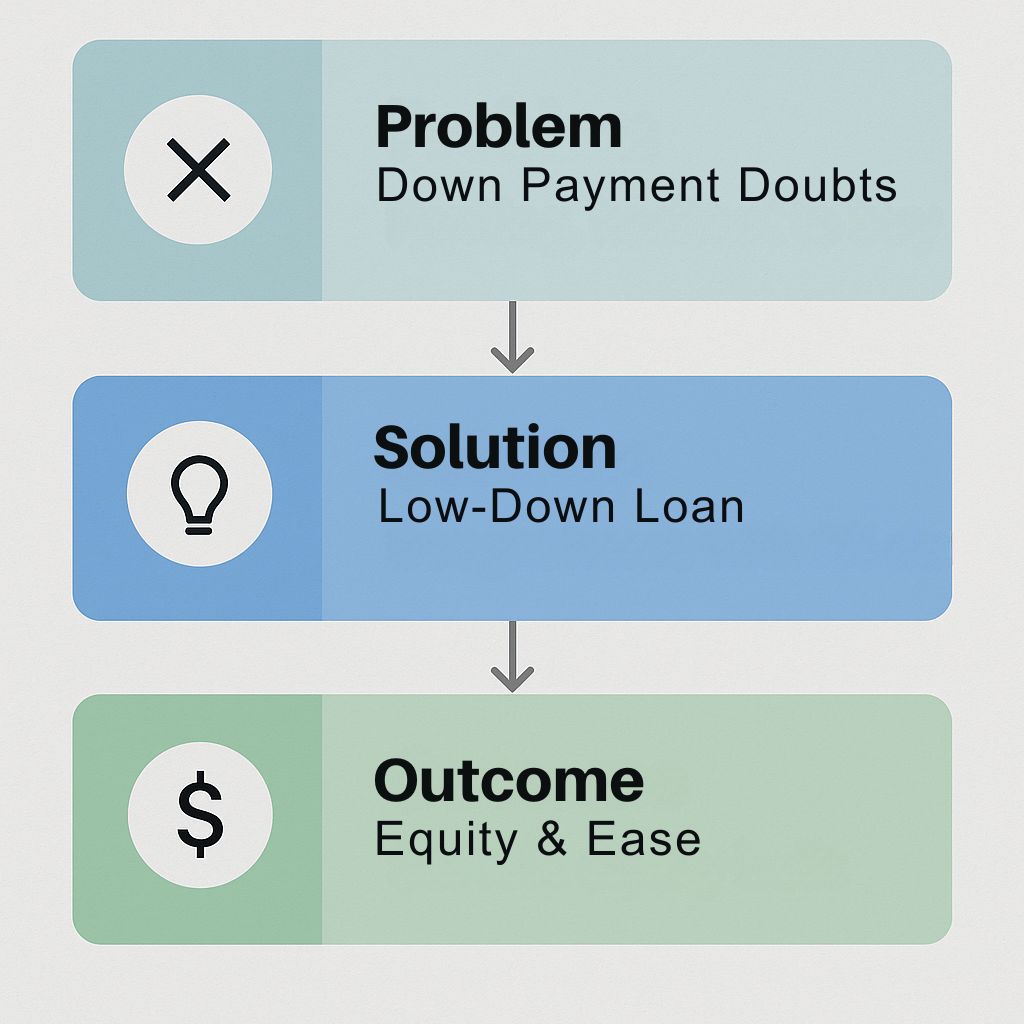

The Challenge

Emily had a stable job, decent credit, and had been renting for five years. She was tired of paying her landlord’s mortgage and wanted something of her own—but she assumed she needed 20% down, which seemed impossible while paying student loans and saving monthly.

After finding a townhome in a safe, up-and-coming neighborhood near her job, she reached out to our team to explore her options.

The Strategy

We showed Emily how she qualified for a Conventional 97 loan, which only required 3% down because she was a first-time buyer.

Other key benefits:

- No upfront mortgage insurance like FHA

- She could cancel PMI after reaching 20% equity

- Better long-term savings compared to an FHA loan over 7+ years

- Seller paid 2% of her closing costs, lowering her out-of-pocket total to under $11K

The Outcome

Emily closed in 27 days, moved in on a Saturday, and hosted friends the next weekend.

Her mortgage payment was $150/month less than her previous rent, and she now owns a home that’s already appreciated $15,000 in 12 months.

Quote from Emily:

“I honestly didn’t think I could buy a home until my 30s. I thought 20% down was required. I’m so glad I asked the question—now I tell all my friends to look into this.”

Ready to Take Your First Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact