Flexible Income Loan: How a Variable Income Family Bought Their Home

- By Jim Blackburn

- on

Client Profile

- Names: Kevin & Priya M.

- Ages: 40 & 38

- Professions: Bartender (W-2 + tips) & Freelance Photographer (1099)

- Location: Austin, TX

- Home Type: 4-bed suburban home

- Purchase Price: $426,000

- Loan Type: Flexible Income Mortgage (W-2 + Alt Doc Combo)

- Down Payment: 10%

- Credit Scores: 702 & 679

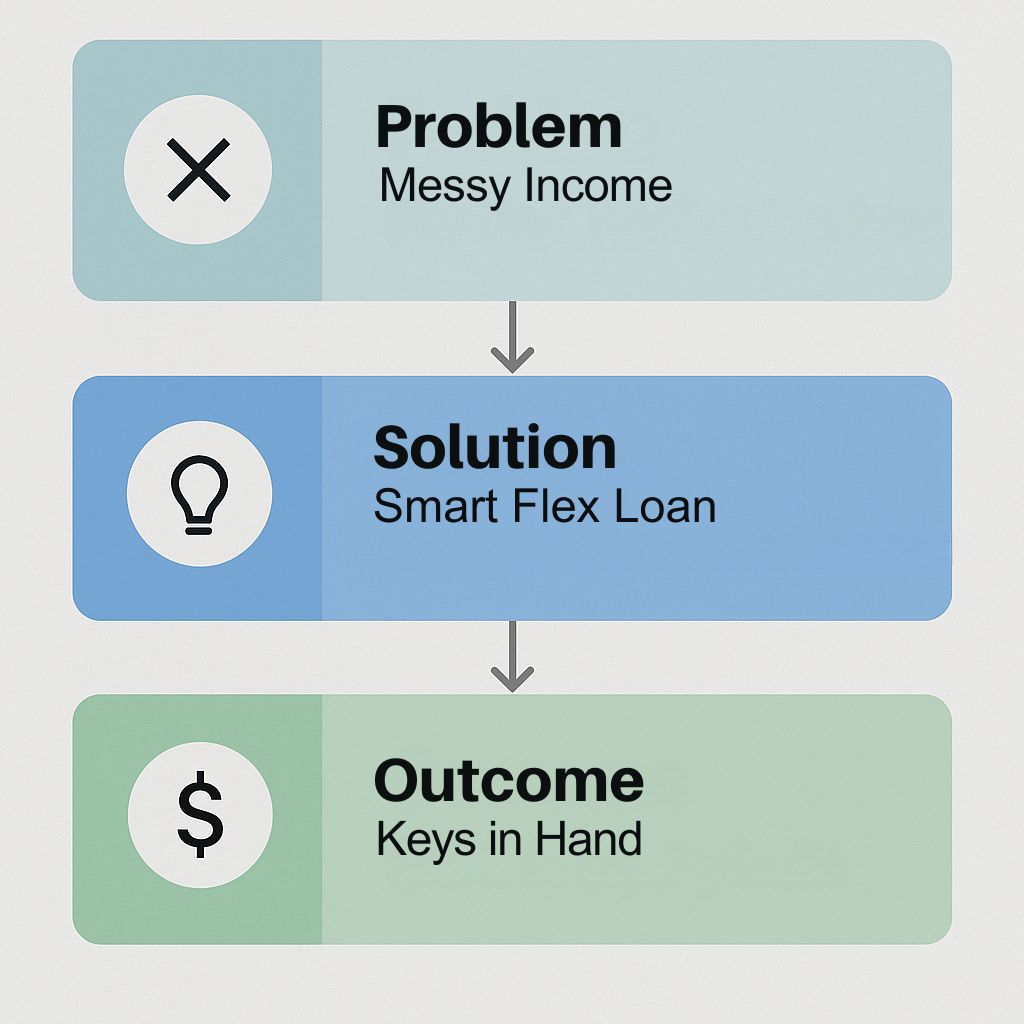

The Challenge

Kevin and Priya were solid renters but had been denied by a conventional lender due to their “blended” income types. Kevin’s pay varied with shifts and tips, and Priya’s freelance income was inconsistent month to month. Their combined income was more than enough—they just couldn’t prove it the traditional way.

The Strategy

We built a custom loan structure using a Flexible Income Loan, combining:

- Kevin’s W-2 base income + averaged tip income

- Priya’s 12-month 1099 and business deposits

- Rent history and strong credit in lieu of tax returns

- Manual underwriting to present the full financial picture

The file was prepped to close cleanly with only moderate documentation.

The Outcome

- They were approved without needing full tax return documentation

- Monthly payment fit well within their actual budget

- They moved into a 4-bedroom home just in time for the school year

- Their lender is now coaching them for a refi into a conventional loan next year

Quote from Kevin:

“We were told ‘no’ just because our income didn’t look neat on paper. This lender saw the real us—and now we’re finally homeowners.”

Ready to Take Your First Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact