How the BRRRR Strategy Helped an Investor Grow Equity and Scale Fast

- By Jim Blackburn

- on

Client Profile

- Name: Malik J.

- Age: 34

- Profession: Real Estate Investor / Property Manager

- Location: Columbus, OH

- First Property Purchase Price: $148,000

- Rehab Budget: $31,000

- ARV (After Repair Value): $225,000

- Loan Types Used: Fix & Flip → DSCR Refinance

- Exit Strategy: Reuse equity for BRRRR round two

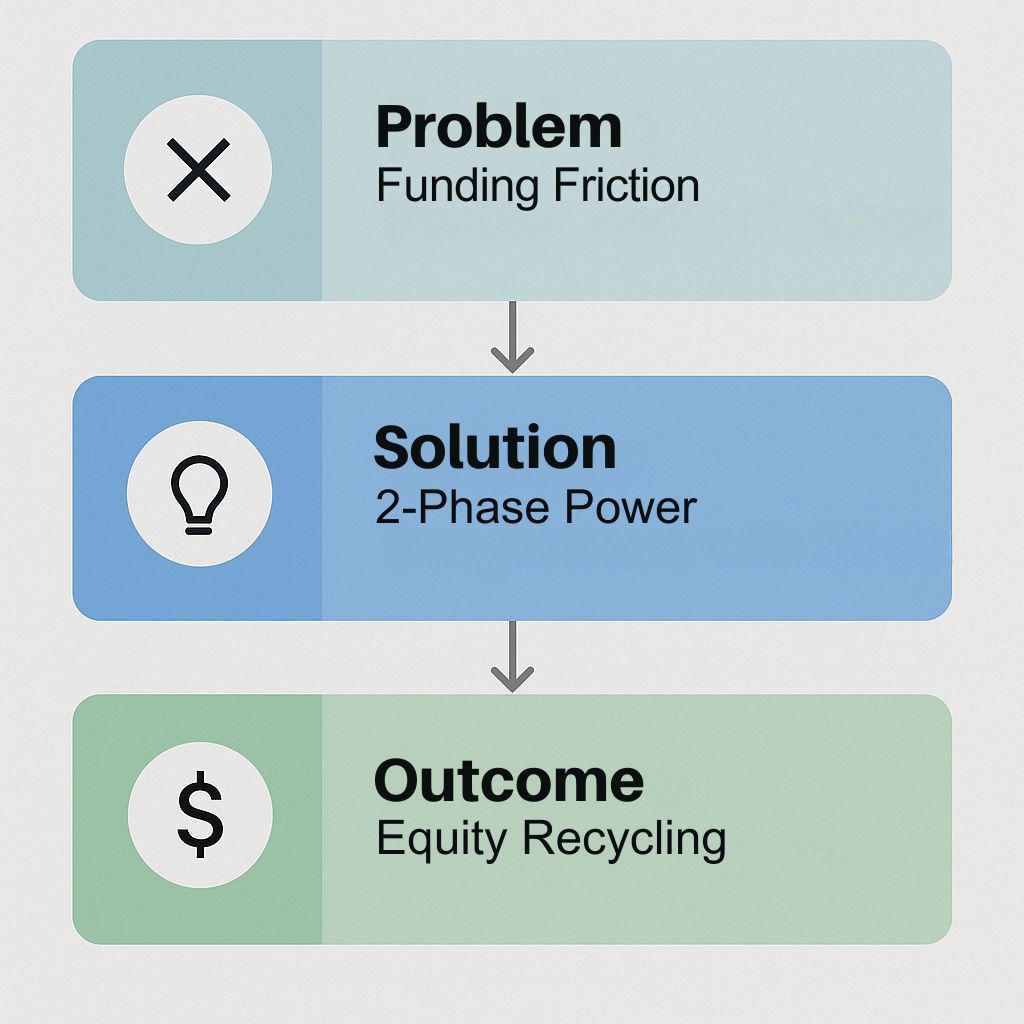

The Challenge

Malik was ready to scale his portfolio, but needed a reliable lending strategy to execute the BRRRR method: Buy, Rehab, Rent, Refinance, Repeat.

The issue? Most lenders couldn’t move fast enough on the acquisition or didn’t understand how to underwrite to post-reno appraised value.

The Strategy

We helped Malik structure a 2-phase lending plan designed for the BRRRR model:

Phase 1: Fix & Flip Loan

- Funded 85% of purchase + 100% of rehab

- Closed in 9 business days

- No income documentation needed

- Rehab completed in 7 weeks

Phase 2: DSCR Refinance

- New loan based on appraised rental value

- Locked in long-term rental financing

- Pulled out $53,000 in equity—tax-free

- Used proceeds for down payment on next deal

The Outcome

- Property cash flows $480/month after all expenses

- Reused equity to begin BRRRR #2 within 45 days

- Built long-term equity while recycling the same cash

- Malik now has 3 doors under management and counting

Quote from Malik:

“This was the first time I felt like my lender was actually part of my strategy. The BRRRR loan sequence changed my game.”

Ready to Take Your First Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact