Buy Now, Refinance Later: Stop Waiting and Start Building Equity

Waiting for interest rates to drop?

Hoping home prices will fall?

You’re not alone — but while you wait, you might be losing more than you think.

At Stairway Mortgage, we help you move forward with confidence today and flexibility tomorrow. Our 3-Year Refinance Guarantee gives you built-in control over your mortgage strategy — so you can stop renting, start building equity, and adjust when the time is right.

Let’s break down the real cost of waiting — and why smart buyers are stepping in now.

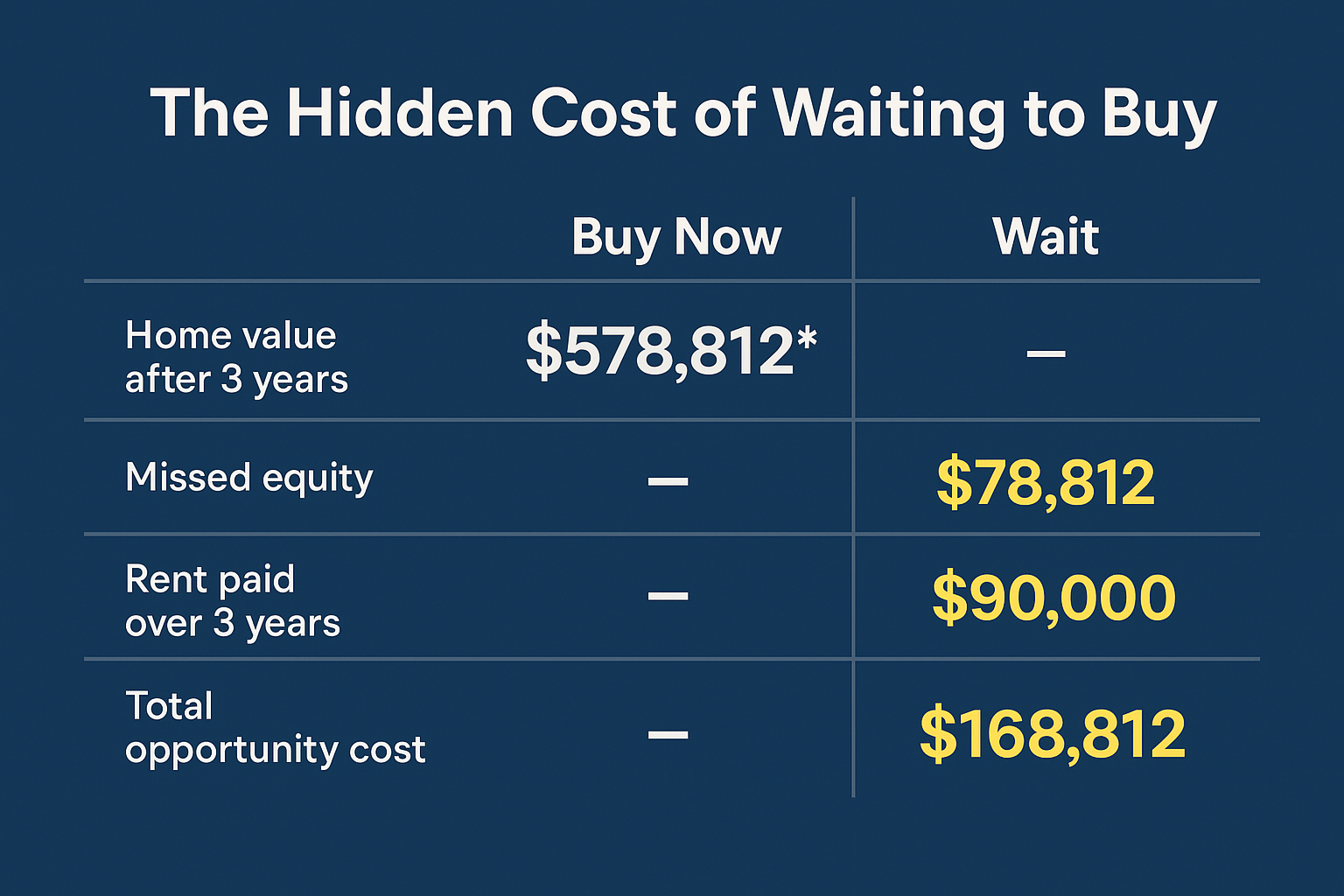

The Hidden Cost of Waiting to Buy

Imagine you’re considering a $500,000 home and decide to wait for lower rates.

If that home appreciates just 5% per year (a conservative estimate), in three years it could be worth $578,812.

That’s $78,812 in missed equity — simply by waiting.

Now add three years of rent at $2,500/month:

That’s $90,000 paid to a landlord, building no wealth.

Total opportunity cost: $168,812.

That’s the price of waiting while the market keeps moving.

The 3-Year Refinance Guarantee

Buy now, and if interest rates improve, you’ll have the opportunity to refinance within 36 months — with up to $2,500 in lender-paid credits to offset your refinance closing costs.

These credits may be applied toward:

- Appraisal

- Title & escrow

- Credit report

- Underwriting

- Processing

- Government or recording charges

There’s no guessing, no pressure — just a strategy that gives you freedom to move now and flexibility to adjust later.

Why It Matters

Some buyers sat on the sidelines last year, waiting for rates to fall.

Now? Home prices have risen. Inventory is tight. And many are priced out.

You don’t need to wait for perfect conditions — you need a smart structure that lets you act now and pivot later without financial regret.

That’s what our 3-Year Refinance Guarantee delivers.

What’s Covered When You Refi

When you refinance through Stairway Mortgage within 36 months of your purchase, you’ll receive up to $2,500 in lender-paid credits that may be applied toward:

- Appraisal fees

- Title and settlement services

- Underwriting and processing fees

- Credit report

- Government and recording charges

This is part of your wealth-building plan, not a short-term promo.

The Fine Print (Summarized)

- One-time use only

- Must refinance through Stairway Mortgage (not other NEXA teams)

- Must wait at least 180 days after your purchase before refinancing

- Available for refinances completed within 36 months of your original funding date

Click here to view full terms →

Ready to Move Forward?

We offer several ways to take the next step — based on where you are in the process:

- Get Approved if you’re actively shopping

- Schedule a Call if you want guidance on your timeline

- Take the Discovery Quiz to explore your options

- Spin to Win if you’d rather test your luck (we recommend strategy)

At Stairway Mortgage, we help you act with clarity — and adapt with confidence.

Ready to Take Your First Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- 💡 Takes just 5 minutes

- 📊 Tailored results based on your answers

- 🔒 No credit check required

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- 💡 Only 2 minutes to complete

- 📊 Quick turnaround on pre-approval

- 🔒 No credit score impact