Combo Loans | How to Buy a Primary Home and Investment Property at the Same Time

Why Buy One Property When You Can Strategically Buy Two?

Savvy buyers are taking advantage of creative mortgage strategies that allow them to purchase both a primary residence and an investment property—at the same time. It’s called a combo loan approach, and it could be your ticket to building wealth while covering your own housing needs.

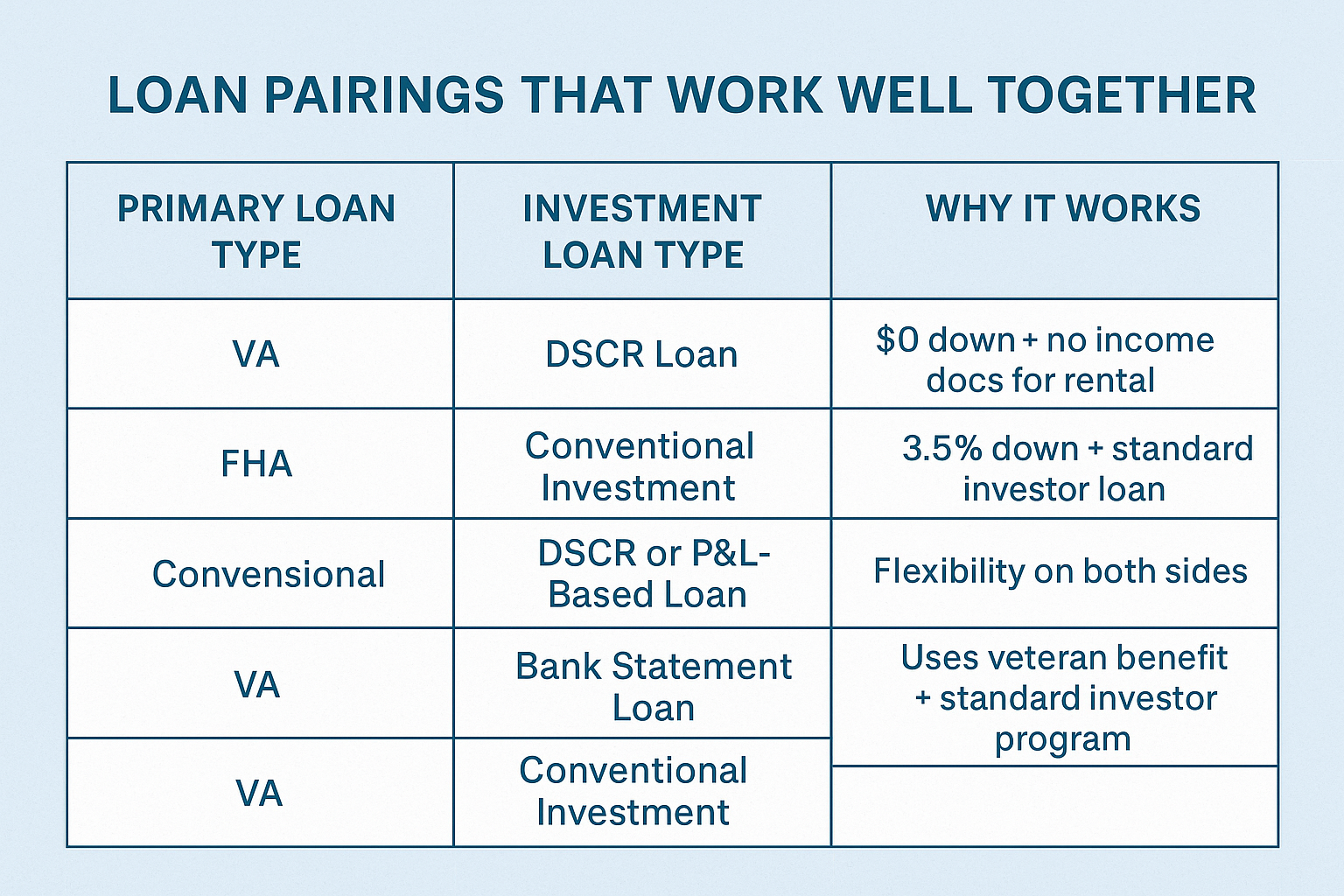

Whether you’re combining VA and DSCR loans, or blending FHA with Conventional, the strategy is the same: leverage low down payment programs for your home while financing a cash-flowing rental alongside it.

What Is a Combo Loan Strategy?

A combo loan strategy involves structuring two mortgages at once:

- Primary Residence Loan – For the home you’ll live in (e.g., VA, FHA, or Conventional)

- Investment Property Loan – For a rental property, often using a DSCR or Non-QM program

Each loan stands on its own—but with the right planning, they can close simultaneously or within a short time frame to capitalize on low rates, rising rents, or market opportunities.

Why It Works

- Leverage low or $0 down on your primary (VA or FHA)

- Use rental income to qualify on investment (DSCR, Conventional, or Non-QM)

- Diversify your equity across two appreciating assets

- Turn your first deal into a portfolio strategy

This is a perfect move for:

- Military families using VA eligibility

- Dual-income households wanting to invest

- Buyers relocating or house-hacking

First-time investors who want a safe launch point

Best Loan Combos to Consider

How to Structure the Combo Loan

- Start with a clear budget and goal for both properties

- Pre-approve for both loans in parallel (different lenders if needed)

- Decide which to close first (primary often closes first for better terms)

- Use available funds for minimum down payment + reserves

- Let the rental income help offset future debt-to-income

You don’t need millions to pull this off. You need the right guidance.

Final Word: Live In One. Invest in Another. Build Wealth with Both.

Combo loans are how smart buyers leapfrog ahead. Instead of buying a home or an investment, you build a plan that gets you both—structured for long-term wealth and short-term cash flow.

Ready to Take Your First Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- 💡 Takes just 5 minutes

- 📊 Tailored results based on your answers

- 🔒 No credit check required

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- 💡 Only 2 minutes to complete

- 📊 Quick turnaround on pre-approval

- 🔒 No credit score impact