Construction Loan & DSCR Loans | Build a Short-Term Rental, Then Refi on Rental Income (No Tax Returns)

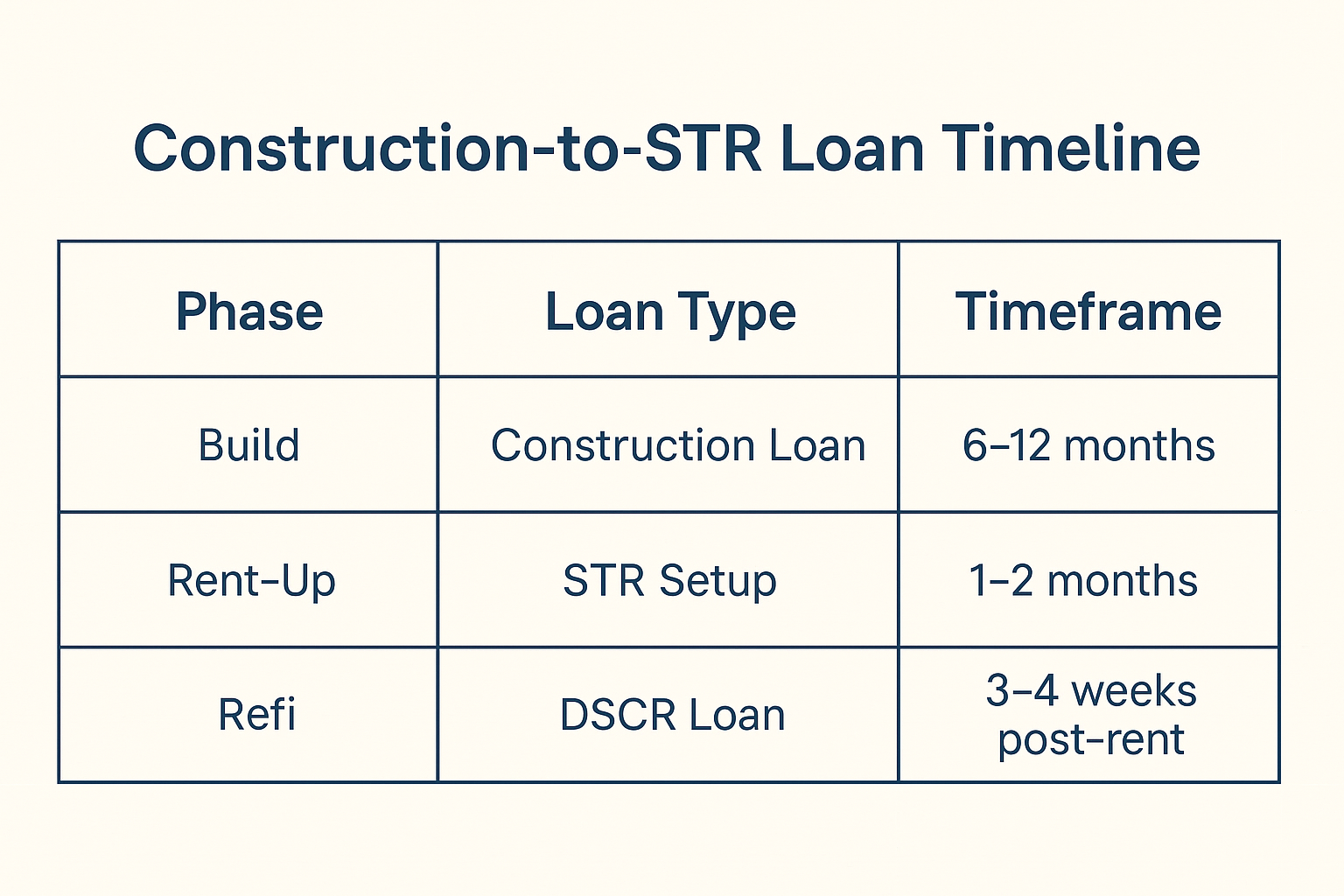

If you’re an investor looking to build a short-term rental (STR) from the ground up, there’s a powerful combo that can help you scale fast: use a construction loan to fund the build, then refinance into a DSCR loan once the rental is cash-flowing.

This two-step strategy helps you:

- Finance new construction without traditional income

- Cover the build phase with interest-only payments

- Lock in a long-term rental loan based on property income, not personal income

Step 1: Use a Construction Loan to Build Your STR

A construction loan funds the cost of land, permits, labor, and materials. It’s typically interest-only during the build phase and converts into a permanent loan—or you can refinance once the build is complete.

Key Features:

- Covers land + build + soft costs

- Interest-only payments during construction

- Builder and plans must be approved by lender

- Typically 12-month term (extensions possible)

Ask us about one-time-close options to simplify the paperwork.

Step 2: Refinance into a DSCR Loan

Once the property is complete and listed as a short-term rental, you can refinance into a DSCR loan. These loans use the property’s rental income (not your W-2s) to qualify.

How DSCR Loans Work:

- DSCR = Rent / Monthly Payment

- Most lenders want 1.0+ ratio (some accept 0.75+)

- No tax returns, pay stubs, or personal income needed

Once your STR starts cash flowing, we’ll refinance you into a DSCR product with competitive long-term terms.

Why This Strategy Works for STR Investors

- Avoids upfront cash requirements of all-cash builds

- Lets you scale without hitting income caps

- Ideal for high-demand Airbnb/VRBO markets

- Smart for remote investors building out-of-state

Want to analyze your numbers? Use our Construction-to-STR Calculator.

Final Word: Don’t Just Build—Build Smart

This strategy gives you flexibility on the front end and scalability on the back. We’ll walk you through the lender approvals, draw schedules, and income analysis needed to turn your short-term rental idea into a cash-flowing asset.

Ready to Take Your First Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- 💡 Takes just 5 minutes

- 📊 Tailored results based on your answers

- 🔒 No credit check required

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- 💡 Only 2 minutes to complete

- 📊 Quick turnaround on pre-approval

- 🔒 No credit score impact