Can You Buy a Home with a Reverse Mortgage? Yes — Here’s How.

- By Jim Blackburn

- on

- purchase, real estate investing, reverse mortgage, vision board, wealth plan

Most people think reverse mortgages are only for homeowners who want to stay put.

But did you know you can actually use a reverse mortgage to buy a new home?

It’s called a Home Equity Conversion Mortgage for Purchase (HECM for Purchase) — and it could be one of the smartest ways to right-size your home without adding a monthly mortgage payment.

Let’s walk through how it works — and why more seniors are using it to create the lifestyle they actually want.

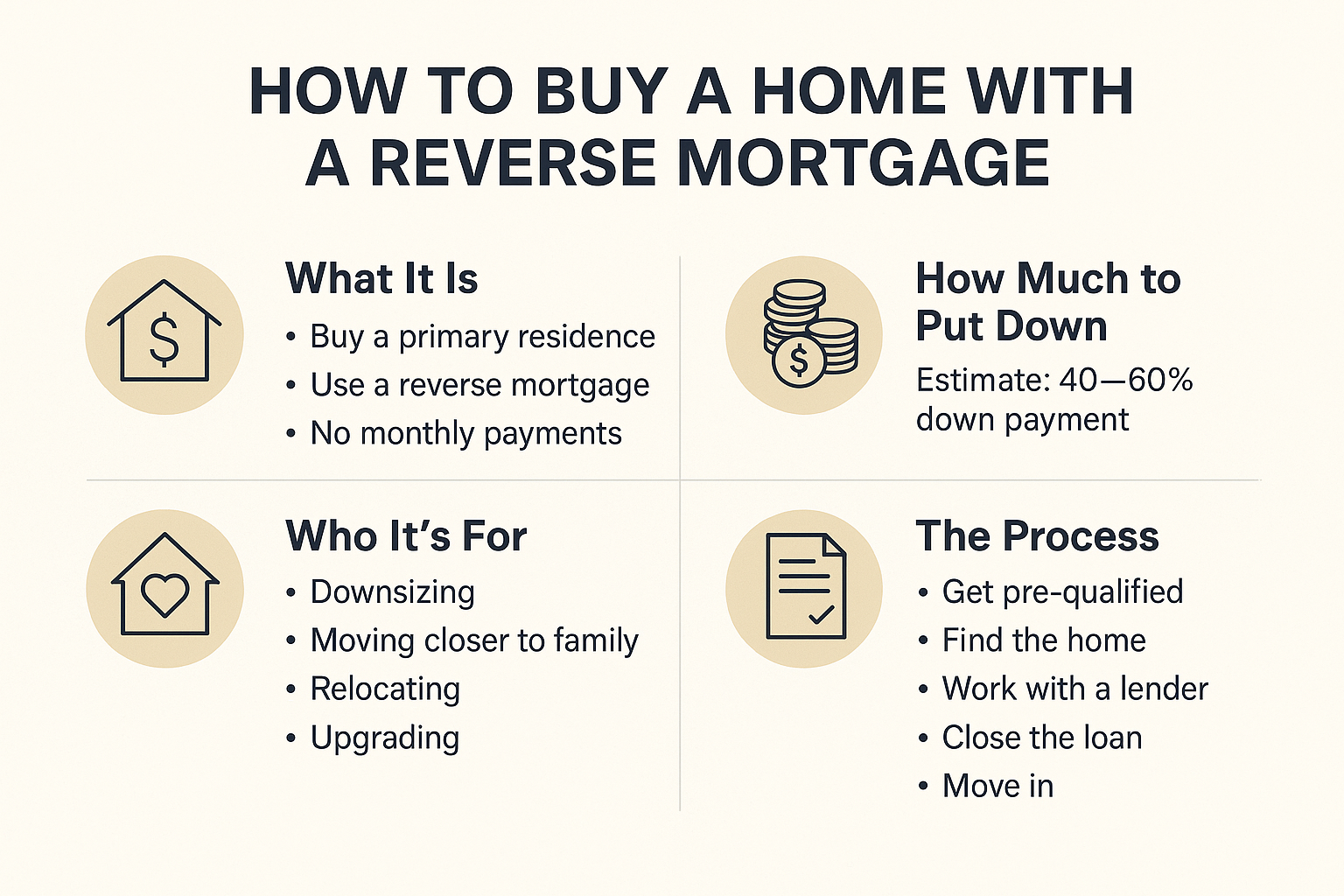

What Is a HECM for Purchase?

A HECM for Purchase is a reverse mortgage that lets you:

- Buy a new primary residence

- Use a portion of your savings as a down payment

- Cover the rest with a reverse mortgage

- And avoid monthly mortgage payments for as long as you live in the home

You still own the home, retain the title, and control the sale or inheritance process just like a traditional reverse mortgage.

Want to see the numbers? Use our Reverse Mortgage Home Purchase Loan Calculator to estimate your down payment, loan amount, and how much cash you’ll preserve for other needs.

Who Is This For?

A reverse mortgage purchase might be perfect if you want to:

- Downsize to a more manageable home

- Move closer to family or medical care

- Relocate to a better climate or safer community

- Upgrade to a home that better suits your current needs

- Preserve cash while keeping your housing costs predictable

Instead of paying all cash or taking out a traditional loan with monthly payments, you get the best of both worlds — ownership without the payment burden.

Explore how a reverse mortgage purchase compares to paying all cash or getting a traditional loan. Our Reverse Mortgage calculators show you the real difference in monthly obligations and cash preservation.

How Much Do You Need to Put Down?

The required down payment varies based on:

- Your age

- The home’s purchase price

- Current interest rates

Most buyers use 40–60% of the home’s value as a down payment.

The reverse mortgage covers the rest.

Example:

- You buy a $400,000 home

- You put down ~$200,000 (from sale of a previous home or savings)

- The reverse mortgage covers the other ~$200,000

- You never make a monthly payment again (as long as you live there)

Run your specific scenario with our Reverse Mortgage Home Purchase Loan Calculator to see exactly how much you’d need to bring to closing based on your age and the home price you’re targeting.

How the Process Works

- Get pre-qualified for a reverse purchase

- Find the right home (must be your primary residence)

- Work with a lender and a reverse-certified real estate agent

- Bring the required down payment to closing

- Move in — and stay as long as you like, payment-free

We’ll guide you through every step and coordinate with your agent and attorney to ensure it all runs smoothly.

Before you start house hunting, understand all your reverse mortgage options including the Reverse Mortgage Cash-Out Refinance if you want to tap equity from your current home, or the Reverse Mortgage Income for Life calculator to see how it can provide monthly income.

Why Seniors Love This Option

- Keeps more cash in your pocket

- Eliminates the need to qualify for a traditional mortgage

- Offers more flexibility than an all-cash purchase

- Makes it easier to “right-size” without sacrifice

See the full picture with our Reverse Mortgage Legacy Inheritance Estimator to understand what equity could remain for your heirs over time.

Want to Move Smart and Keep Your Cash?

You’re not stuck in your current home — and you don’t have to spend your entire nest egg to move.

A reverse mortgage for purchase gives you the freedom to right-size your life without draining your savings.

Here’s how to explore your options:

🏡 Calculate your purchase power with the Reverse Mortgage Home Purchase Loan Calculator to see how much home you can buy and how much cash you’ll keep

💰 Explore the Reverse Mortgage Income for Life calculator if you want to create steady monthly income from your home equity

👨👩👧👦 Use the Reverse Mortgage Legacy Inheritance Estimator to see what equity could pass to your family over time

📊 Plan your complete retirement strategy with our Legacy Impact Planner to see how your housing decisions fit into your bigger financial picture

Ready to Take Your First Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Let’s talk it through. Book a call and one of our friendly advisors will be in touch to guide you personally.

Schedule a Call