The Power of the Step-Up in Basis for Legacy Wealth

- By Jim Blackburn

- on

- purchase, real estate investing, vision board, wealth plan

Real estate is one of the most powerful ways to build generational wealth.

But there’s one lesser-known tax rule that can quietly protect that wealth and pass it on — almost tax-free.

It’s called the step-up in basis — and if you own property, you need to understand it.

It could mean the difference between your heirs paying nothing in taxes… or owing tens of thousands.

What Is a Step-Up in Basis?

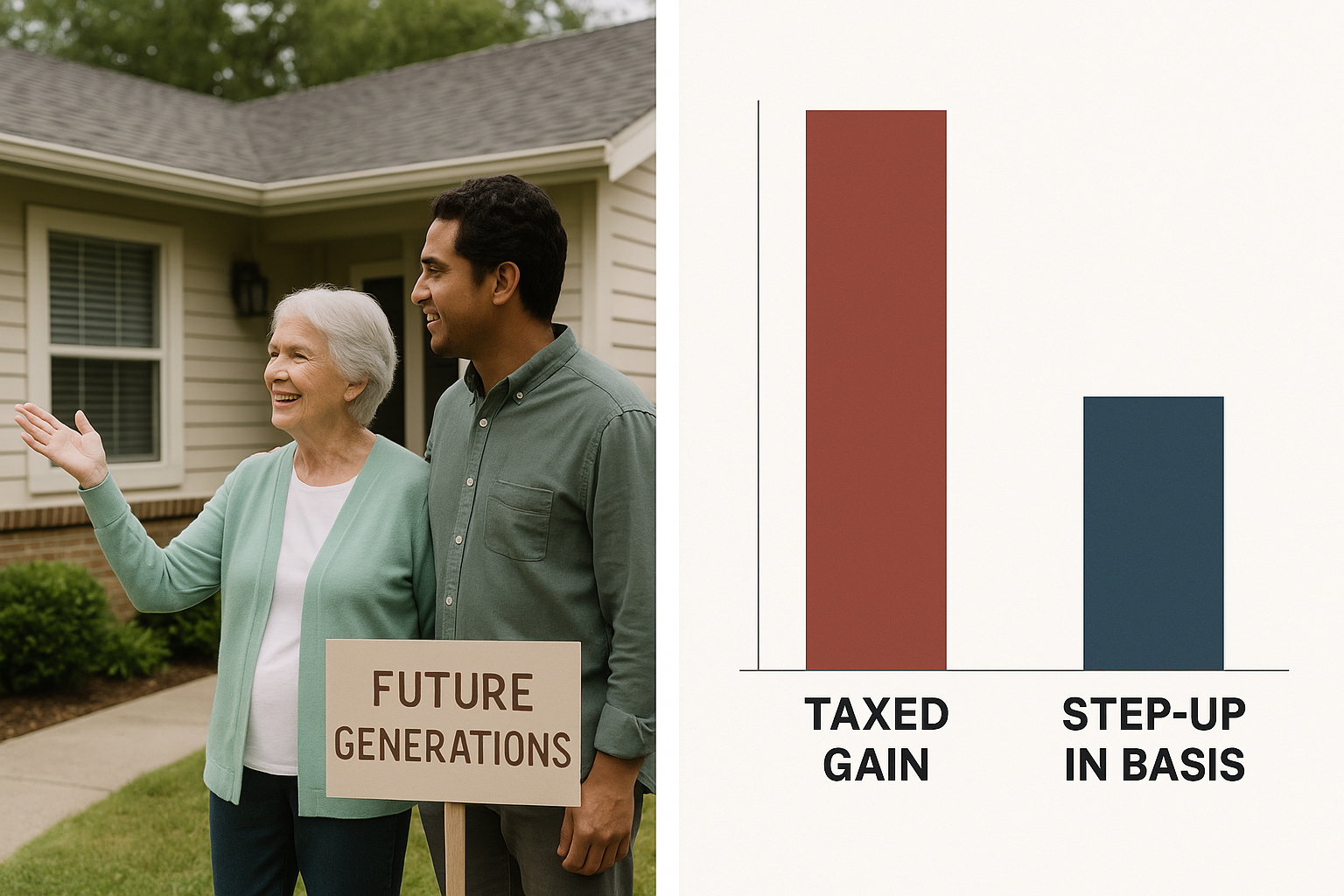

When you pass down an asset (like a house), the “basis” is what determines capital gains tax.

- If you bought the house for $200K, that’s your basis

- If it’s worth $500K when your heirs inherit it, the gain is $300K

- Normally, that gain would be taxed if sold

But with a step-up in basis… your heir’s basis becomes $500K — the value at time of death

So if they sell it immediately? No capital gains tax owed

Understanding how real estate transfers impact your wealth plan is critical. Use our Legacy Impact Planner to see how property ownership decisions today affect your family’s inheritance tomorrow.

How It Builds Legacy Wealth

This strategy helps your heirs:

- Inherit the full market value

- Avoid unnecessary capital gains taxes

- Keep or sell the home with flexibility and peace of mind

And it helps you:

- Transfer your equity tax-efficiently

- Ensure your lifetime gains aren’t drained by IRS bills

- Leave behind usable wealth, not taxable burden

Learn how strategic property investment creates generational wealth with our Buy and Hold Real Estate calculator to see how cash flow, equity growth, and tax benefits compound over time.

What Types of Property Qualify?

- Primary residence

- Investment properties

- Land

- Vacation homes

As long as the property is part of your estate, the step-up can apply.

(Trusts, LLCs, and other structures may affect this — ask your advisor.)

Whether it’s your primary residence, investment property, or vacation home, explore financing options with our loan calculators to understand how different property types fit your legacy strategy.

How to Maximize the Step-Up Strategy

- Hold appreciated property until death, when appropriate

- Use a revocable living trust to simplify inheritance

- Avoid gifting appreciated property during your lifetime — it locks in the old basis

- Coordinate with your mortgage advisor and financial planner for a full legacy plan

For investment properties, explore strategies like the BRRRR Method to build a portfolio that maximizes both current cash flow and future step-up basis benefits for your heirs.

Want to Build Tax-Efficient Generational Wealth?

Real estate offers powerful tax advantages when planned strategically. Here’s how to maximize your legacy:

📊 Map your complete wealth transfer strategy with the Legacy Impact Planner to see long-term tax implications

🏘️ Learn how Buy and Hold Real Estate creates wealth through appreciation, cash flow, and tax benefits

🔄 Build a portfolio using the BRRRR Method to acquire multiple properties that benefit from step-up basis

💰 Explore financing for different property types with our loan calculators to build your legacy portfolio strategically

Ready to Take Your First Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Let’s talk it through. Book a call and one of our friendly advisors will be in touch to guide you personally.

Schedule a Call