Should I Pay Points to Lower My Rate?

- By Jim Blackburn

- on

- purchase, real estate investing, vision board, wealth plan

Should You Pay Points to Lower Your Rate?

If you’ve ever gotten a mortgage quote and seen “discount points” or “rate buydown” listed, you might have wondered…

Is it worth paying extra upfront to get a lower interest rate?

The answer?

Sometimes yes. Sometimes no.

It all depends on how long you plan to hold the loan and what your financial goals are.

Let’s break it down in simple terms so you can make the right decision for your strategy.

What Are Discount Points?

A “point” is a fee you pay to the lender upfront at closing to reduce your mortgage interest rate.

- 1 point = 1% of your loan amount

(On a $400,000 loan, 1 point = $4,000) - In return, your rate might drop by 0.25% to 0.5%, depending on the market

Think of it like prepaying interest to save more over time.

Want to see how points affect your total costs? Calculate your Compare 2 Rates (Interest Costs) now to compare scenarios with and without discount points and understand your break-even timeline.

When It Makes Sense to Pay Points

Paying points is like investing in a lower monthly cost. It can be a smart move if:

- You plan to stay in the home (or hold the loan) for 7+ years

- You want to lower your monthly payment for budget reasons

- You’re locking in a rate in a rising-rate environment

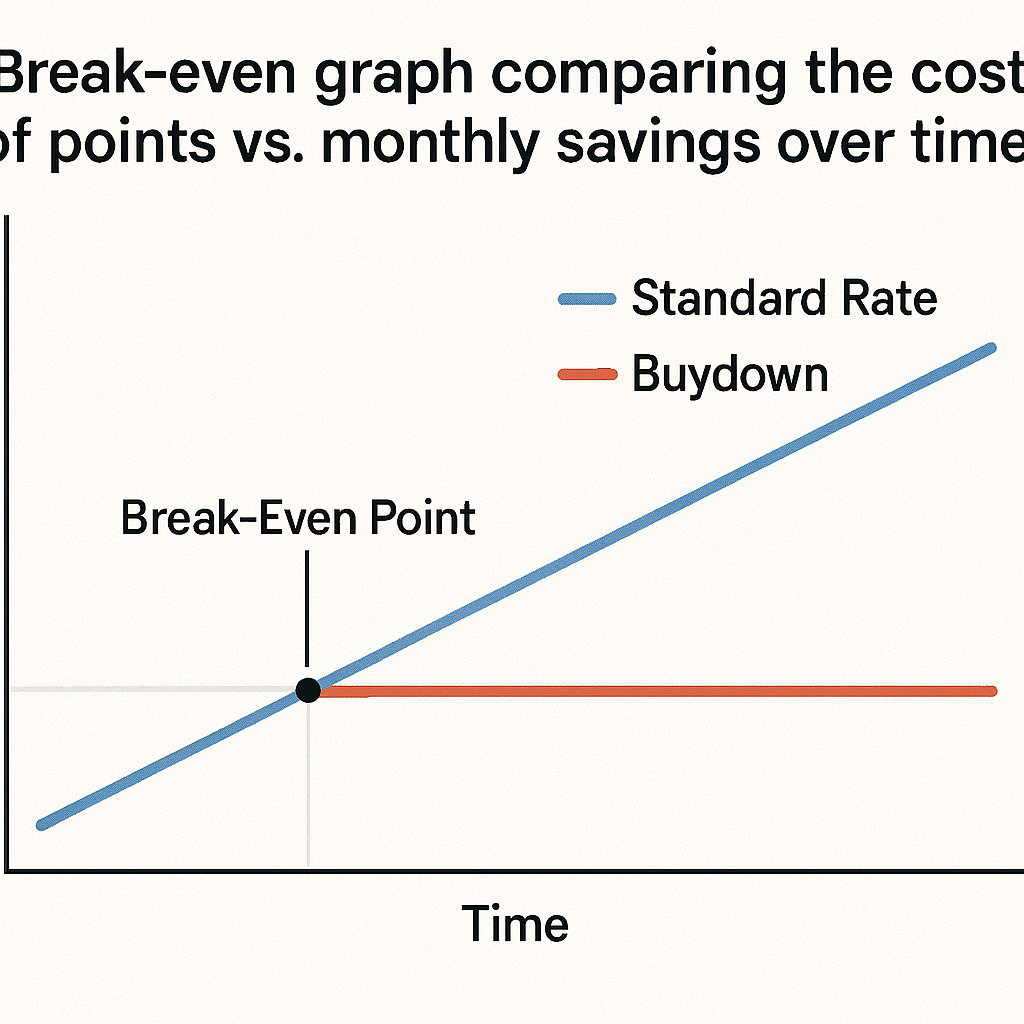

What’s the Break-Even Point?

Here’s the key question:

How long will it take for the monthly savings to equal the cost you paid upfront?

Example:

- Pay $4,000 to reduce rate by 0.375%

- Save $75/month

- Break-even = 54 months (~4.5 years)

If you’ll keep the loan longer than 4.5 years? You win.

Sell or refinance earlier? You may not recoup the cost.

Understanding your complete loan structure helps with the points decision. Calculate your Conventional Purchase Loan Payment now to see how different rate and point combinations affect your monthly payment and total loan costs.

When NOT to Pay Points

Paying points may not be smart if:

- You’re buying a starter home and plan to move in a few years

- You think you’ll refinance soon (if rates drop or income improves)

- You’d rather keep cash for renovations, investments, or reserves

Also: Some lenders pitch points as a profit tool — not a strategy.

That’s why it helps to work with a team that runs the math with your goals in mind.

Points Are a Strategy, Not a Requirement

You don’t have to buy down your rate.

But in the right situation, it can create serious savings.

Let’s help you figure out if it makes sense — or if your money is better used elsewhere.

Need help evaluating whether to pay points? Visit our Buy a House page for comprehensive resources about mortgage strategies, rate structures, and making informed financing decisions.

Want help comparing options?

At Stairway Mortgage, we help you make strategic decisions about points, rates, and loan structure based on your actual timeline and goals.

📘 Download our homebuyer guides about mortgage strategies.

🧮 Compare scenarios with our Compare 2 Rates Calculator.

📊 Check Current Rates with and without points.

🏠 Learn more on our Buy a House page.

Ready to Take Your First Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Let’s talk it through. Book a call and one of our friendly advisors will be in touch to guide you personally.

Schedule a Call