NEXA Mortgage: A Partnership Built for Clients, Powered by Strategy

300+ Lending Partners. Flexible Loan Optons. And Now a Direct Lender, NEXA Lending.

Why We Partnered With NEXA Mortgage

At Stairway Mortgage, we focus on helping clients build real, lasting wealth through strategic real estate leverage. To do this well, we partnered with the most powerful mortgage brokerage platform in the country—NEXA Mortgage, founded by visionary leader Mike Kortas.

This partnership means:

- Competitively priced interest rates through wholesale lending

- Faster closings through streamlined systems

- More loan options for every financial scenario

- Strategy-first support, not sales-first pressure

What NEXA Mortgage Brings to the Table

Wholesale Interest Rates

Conventional, VA, FHA, jumbo, DSCR, non-QM, and more.

300+ Lender Network

Mortgage network expanding all through the states.

3000+ Loan Officers

Trusted by thousands of loan officers nationwide.

Integrated Tech

Lower costs. More savings. No retail markup.

Industry Reputation

NEXA’s Loan Operating System speeds up every step.

What Stairway Brings to the Table

Stairway Mortgage trains Certified Stairway Advisors™ to go beyond traditional lending. We guide clients to make strategic financial decisions that grow wealth over time.

We teach our clients how to:

- Turn principles into a plan

- Use leverage responsibly

- Think like investors

- Protect assets & equity

- Optimize tax & retirement

- Create lasting legacy

NEXA Mortgage by the Numbers

Loan Officers

in Annual Volume

Licensed in 48 States

#1 Broker Since 2021

NEXA’s proprietary Loan Operating System connects everything—processors, underwriters, title, and even insurance—into a single platform. It’s modern, fast, and built to serve.

The NEXUS of Financial Power

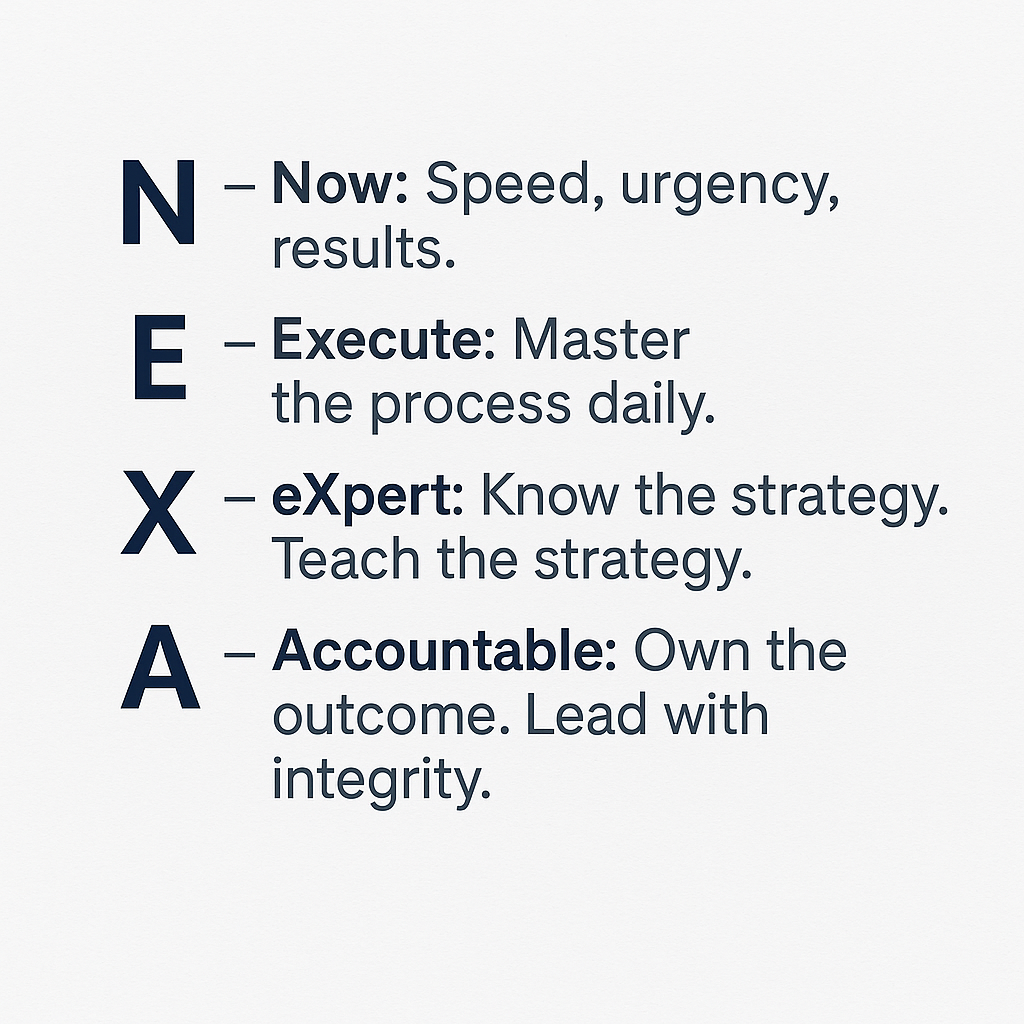

The name NEXA comes from the Latin nexus, meaning connection. To build on this, Jim Blackburn created the NEXA acronym—defining the core values of the types of elite financial professionals that we like to partner with:

Featured Bios

Visionaries Powering Your Process

Mike Kortas

CEO of NEXA Mortgage

Paul Adams

CIO of NEXA Mortgage

Mike Neill

Director of NEXA Lending

Chris Porter

General Counsel of NEXA Mortgage

Dan Fouts

LOS Director of NEXA Mortgage

Rana Mortensenr

Executive Director of NEXA Mortgage

Karen Enslin

BDM Director of NEXA Mortgage

Apple Bugarin

Payroll and Ledger Director of NEXA Mortgage

100% Client Satisfaction

Real Comments, Real People

Hear From Some Past Clients of Stairway's Visionary

Easy and quick refinance with great rates and expert advice.

I recently refinanced my existing mortgage with Jim and his team, and I was so pleased with how easy and quick the whole process was. Jim and his team were very responsive to my questions, and I feel confident that I got the best rate and shaved 9 years off my mortgage. He is very knowledgeable and helped me determine the best option for myself and my family. Definitely recommend him.

Complex loan scenario handled with expertise and care.

The process went smoothly. Jim Blackburn is a lending saint. He knows the market well and cares about his clients tremendously. The team made it really easy to do business, uploading documents and getting forms signed. Our situation is a bit complex. Rather than turn us away for some added work, they dug in to get it done right. They like the complexity, whereas other lenders don’t want to roll up their sleeves. Highly recommend Jim Blackburn for new loans and refinances!

Closed in time for Thanksgiving! Jim and his team were amazing, and we got a much better deal than previous lender.

We closed our loan within 19 days. Just in time for Thanksgiving!! Jim and his team are amazing! We initially had gone with a different loan office and the interest rate and down payment was ridiculous. The owner of the company where my husband works referred us to Jim and we are very grateful for that. We had such an amazing experience with Jim and his team! Since our transaction, we’ve been referring Jim to anyone we know that are thinking of purchasing a house.

Secured financing despite market challenges and self-employment.

Run, don't walk to work with Jim and his team. Jim helped us get financing when it seemed like an impossible feat. It was hard enough to be managing a home purchase 2000 miles away, but add to that an extremely competitive market and being self-employed, and it seemed impossible until Jim's team got involved. Jim was not only responsive; he consistently went above and beyond by making clear recommendations, working his magic, and ensuring that financing wasn’t a barrier for buying our dream house in one of the most competitive markets in the country.

Smooth, fast, and hassle-free mortgage and refinance process.

Jim and his team are great to work with! We have used Jim twice with our home mortgage. Both times, the process was smooth and uneventful (which is what I wanted). He has kept in touch with us and contacted us when he felt it was the right time for us to refinance! I was amazed at our refinancing process – it took them about a little over two weeks to process all our information and close! I love the new online process of submitting all the information they require – it made it super easy for me to organize and gather all the documents.