FHA Home Loans Explained: What First-Time Buyers Need to Know

Buying Your First Home? FHA Might Be the Key.

If you’re buying a home and don’t have perfect credit—or a huge down payment—an FHA home loan could be your ideal starting point. Backed by the Federal Housing Administration, FHA loans are designed to make homeownership more accessible for everyday Americans.

In this post, we’ll break down exactly how they work, what it takes to qualify, and how you can apply with confidence.

What Is an FHA Home Loan?

An FHA loan is a government-backed mortgage that helps homebuyers with lower credit scores and smaller down payments get approved. It’s one of the most popular options for first-time buyers across the country.

FHA Loan Highlights:

- As little as 3.5% down

- Credit scores starting at 580

- Lower interest rates in many cases

- Allows gift funds and down payment assistance

- More flexible underwriting for credit challenges

Need help figuring out your buying power? Scroll down to use our FHA mortgage calculator.

Who Qualifies for an FHA Home Purchase Loan?

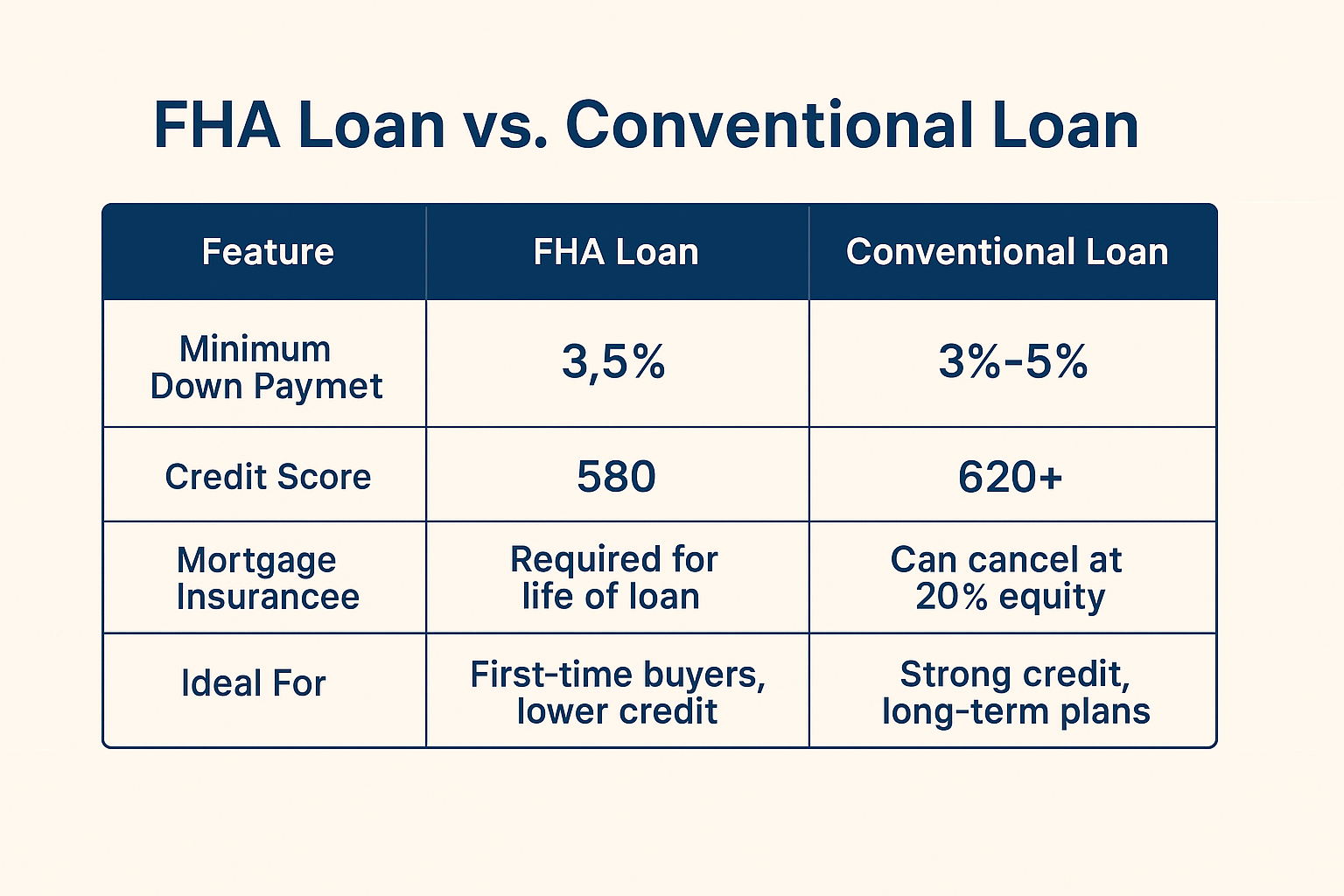

FHA loans are very forgiving compared to conventional loans. Here’s what most borrowers need:

- Credit Score: 580+ (500–579 with 10% down)

- Down Payment: Minimum 3.5%

- Debt-to-Income Ratio: Up to 57% in some cases

- Income & Employment: At least 2 years of history

- Property Type: Must be your primary residence

Have a recent bankruptcy or credit challenge? Check out FHA Credit Event Options

Down Payment Assistance & Gift Funds

Good news—FHA loans allow full down payment gifts from family or employer programs. They also work seamlessly with local DPA programs.

See if you qualify: Explore Down Payment Assistance Options

When Is a Cash-Out Refinance a Good Idea?

You may benefit from a cash-out refinance if:

- You’re carrying high-interest debt and want to consolidate

- You’re planning a major renovation or expansion

- You want capital for investing or buying another property

You’re paying for a large one-time expense like education or a wedding

Final Word: You Don’t Need Perfect Credit to Own a Home

An FHA home purchase loan is built for people just like you—smart, responsible buyers who need a flexible way in. You don’t need to be rich, perfect, or lucky. You just need a plan.

Let’s Build That Plan Together

Get pre-approved. Get answers. Get home.

Ready to Take Your First Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact