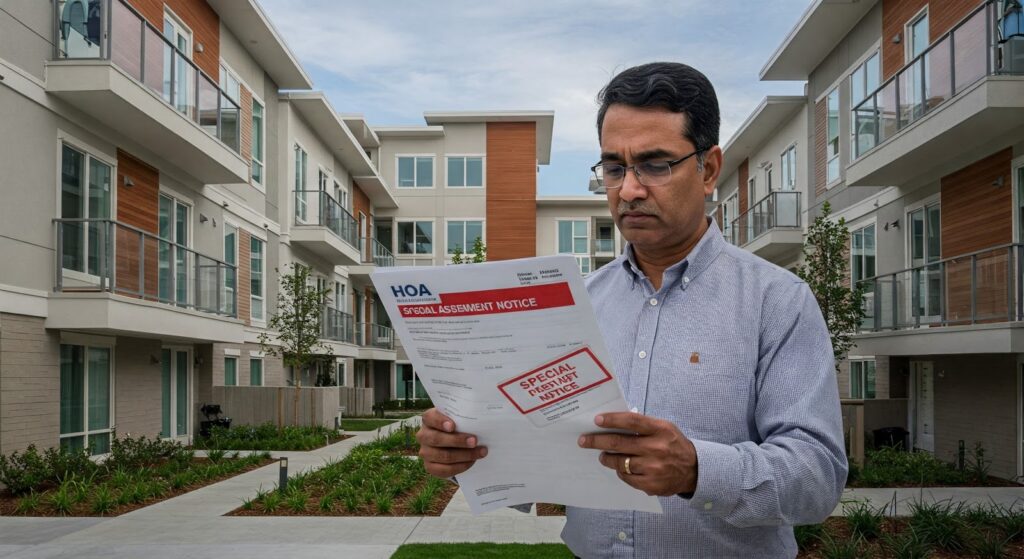

What Is an HOA Special Assessment

- By Jim Blackburn

- on

- 100 first time home buyer FAQs

1. A Special Assessment Is a One-Time Fee for Unexpected HOA Expenses

While monthly HOA dues cover regular expenses like landscaping or pool maintenance, a special assessment is an extra charge that covers major, unplanned costs. These might include:

It’s basically a “surprise bill” from the HOA when their reserve fund falls short.

2. Special Assessments Can Be Large—and Often Come With Little Notice

Depending on the size of the repair or project, your share of the cost could be:

For buyers on a budget, it can feel like getting hit with a hidden cost—after you’ve already moved in.

3. Ask About the HOA’s Financial Health Before You Buy

Before you close, make sure your real estate agent helps you:

A financially healthy HOA = fewer surprises for you later.

Buying Into an HOA? Let’s Make Sure You Know What You’re Signing Up For

At Stairway Mortgage, we help you ask the right questions—

so you don’t get blindsided after you move in.

Ready to Take Your First Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Let’s talk it through. Book a call and one of our friendly advisors will be in touch to guide you personally.

Schedule a Call