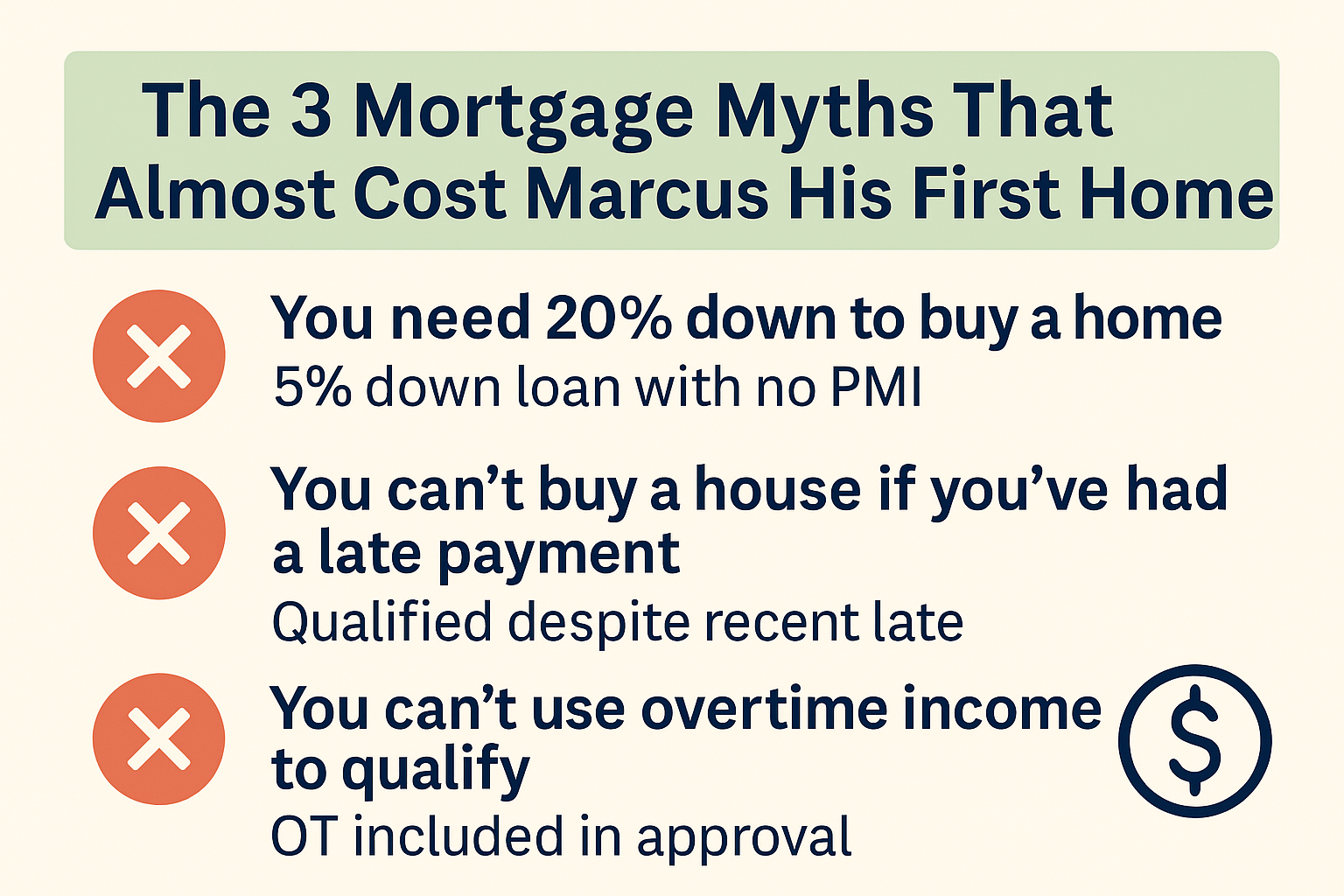

Top 3 Mortgage Myths That Almost Cost Marcus His First Home

- By Jim Blackburn

- on

Client Profile:

- Name: Marcus

- Age: 39

- Occupation: Union electrician

- Goal: Buy a home for his family of four

- Location: Sacramento, CA

The Situation

Marcus had been renting for 14 years. When he finally called us, he admitted he’d almost given up on owning a home — not because of finances, but because of false information.

In 20 minutes, we identified three mortgage myths that had kept him on the sidelines for years.

Myth #1: “You need 20% down to buy a home.”

Truth: Marcus had saved $18K, thinking he needed $60K+.

We showed him a 5% down loan with no PMI due to his strong income and credit.

Myth #2: “You can’t buy a house if you’ve had a late payment.”

Truth: He had a 30-day late payment on a car loan 10 months ago.

We ran it through automated underwriting — and he still qualified with no issue.

Myth #3: “You can’t use overtime income to qualify.”

Truth: As a union electrician, Marcus’s overtime was consistent and documented.

We used a 24-month average to help him qualify for a larger home — and still keep the payment under budget.

The Results

- Purchase Price: $455,000

- Down Payment: $22,750 (5%)

- Loan Type: Conventional 30-year fixed

- Monthly Payment: $2,430

- Home Equity in 1 Year: $32,000 (from market appreciation and principal paid)

What Marcus Said

“I waited way too long because of things I heard from people who weren’t even in the mortgage business. You helped me see that I could have done this years ago.”

Takeaway for Readers

Outdated beliefs keep smart people stuck. Before you assume you can’t qualify — talk to someone who actually knows the rules. What you think you know might be costing you tens of thousands.

Ready to Take Your First Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact