Modernize Your First Home with Just 3.5% Down Using an FHA 203k Streamline Loan

- By Jim Blackburn

- on

Client Profile:

- Name: Angela

- Age: 56

- Occupation: Nurse

- Status: Recently widowed

- Goal: Keep her home and protect her kids’ future

- Location: Fresno, CA

The Situation

Angela and her husband, Victor, had purchased their home 11 years earlier. They were both on the deed, but only Victor was on the mortgage. He passed away suddenly after a brief illness.

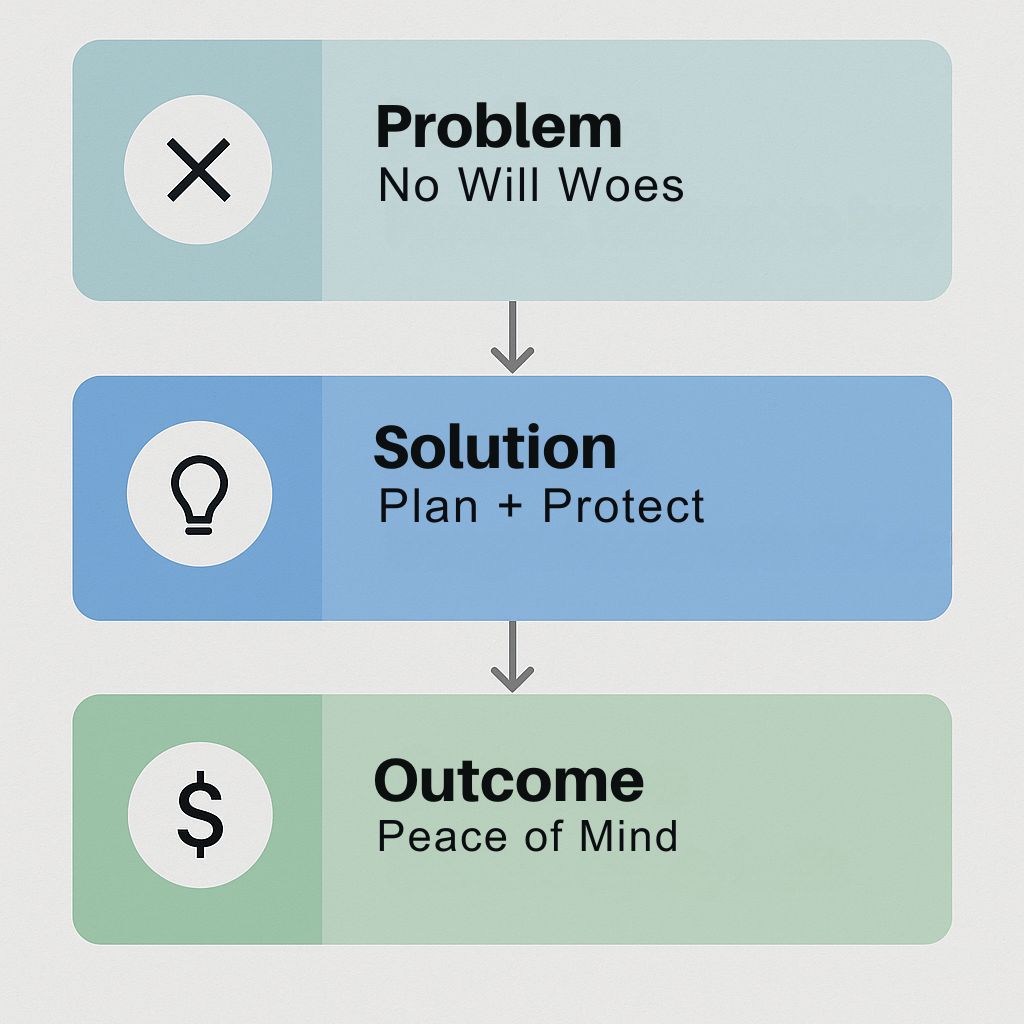

Victor did not leave a will or trust.

Angela assumed she would simply take over the payments and continue living in the home.

But without an estate plan in place:

- The property was frozen in probate

- The mortgage company would not talk to her

- Her name was not on the loan

- She had to make 6 months of payments out of pocket while the courts processed paperwork

The Emotional and Financial Toll

Angela spent:

- $8,500 in attorney fees

- Over 9 months in probate court

- Countless hours gathering paperwork, proving intent, and dealing with stress

She was eventually granted ownership — but the process drained her financially and emotionally.

The Fix — And the Future

After closing probate:

- Angela worked with us and an estate attorney

- She set up a living trust

- Titled her home into the trust

- Appointed a medical directive, durable POA, and successor trustee

- Added term life and disability insurance for her adult daughter (now on title)

What Angela Said

“I had no idea how exposed we were. It’s not just about money — it’s about the mess you leave behind if you don’t plan.”

Takeaway for Readers

If you own a home and have loved ones, estate planning is not optional. It’s the difference between leaving peace — or chaos. Don’t wait until something happens to figure this out.

Ready to Take Your First Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact