Who Qualifies for a Reverse Mortgage (And Who Doesn’t?)

- By Jim Blackburn

- on

- purchase, real estate investing, reverse mortgage, vision board, wealth plan

Not everyone can get a reverse mortgage — and that’s a good thing.

This unique loan is designed for a specific stage of life, with safeguards to ensure it supports the people it was meant to help.

If you’re curious whether you or a loved one qualifies, here’s exactly what lenders look for — and how to tell if this option fits your situation.

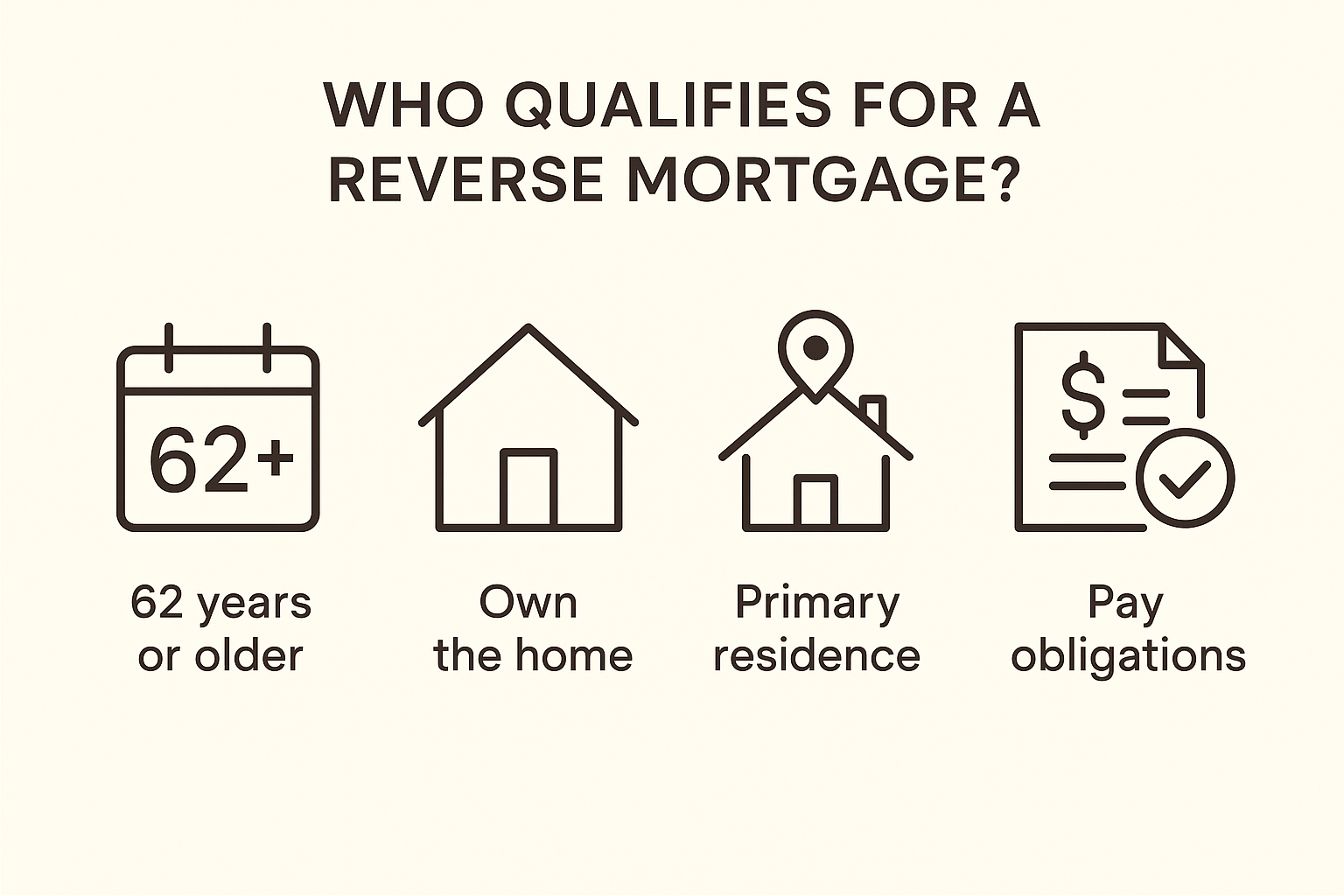

Basic Eligibility Requirements

To qualify for a reverse mortgage, you must meet all of the following:

- Be 62 years or older

(For married couples, at least one spouse must meet this age requirement.) - Own your home outright or have significant equity

- Live in the home as your primary residence

- Stay current on property taxes, insurance, and HOA dues

- Maintain the home in good condition

If you check all of those boxes, you’re on track. But there’s more.

What Types of Homes Are Eligible?

Most reverse mortgages are FHA-backed Home Equity Conversion Mortgages (HECMs), and they come with rules about the type of property you live in.

Eligible homes include:

- Single-family homes

- 2–4 unit properties (as long as you live in one of the units)

- FHA-approved condos or townhomes

- Manufactured homes that meet HUD guidelines

Homes must be in livable condition — no major structural or safety issues. If repairs are needed, we’ll help you determine what qualifies.

What About Credit or Income?

Good news — there are no strict income or credit score requirements like traditional loans.

However, you’ll go through a Financial Assessment to ensure you can:

- Keep up with taxes, insurance, and home maintenance

- Avoid default or foreclosure risk

If needed, some borrowers qualify with a Life Expectancy Set-Aside (LESA) — a portion of funds reserved to cover future tax and insurance costs.

Who Is Not a Good Fit?

Reverse mortgages may not be the right option if:

- You plan to move or sell your home in the near future

- You’re behind on federal debt or property taxes

- You have little to no home equity

- You need a short-term solution (less than 1–2 years)

We’ll walk through your goals honestly — and explore other options if this one isn’t ideal.

Bonus Tip: Talk to Family or Heirs

A reverse mortgage affects your estate — but not necessarily in a negative way.

That’s why we encourage you to involve your children or trusted advisor in the decision. We’ll answer their questions too, and help you plan for:

- What happens when the loan ends

- How heirs can keep or sell the home

- What equity may be left to inherit

It’s not just about qualifying for a loan — it’s about building a smart, peaceful legacy.

Final Thought

Reverse mortgages aren’t for everyone — but they are for homeowners ready to put their equity to work in retirement.

If you meet the qualifications and want to explore how this could support your income, lifestyle, or long-term plan, we’re here to help.

Let’s build wisely. Your stairway starts here.

Ready to Take Your First Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Let’s talk it through. Book a call and one of our friendly advisors will be in touch to guide you personally.

Schedule a CallRecent Post

Passive Investment Return & Tax Advantage Calculator

Heloc Loan Payment Calculator

College Housing Costs VS. Investment Property

Build To Sell Spec Home Calculator: Acquire & Build

1031 Exchange, Capital Gains Tax Savings & Purchase Calculator

VA Renovation Refinance Loan Calculator

VA Renovation Purchase Loan Calculator