What Docs Do I Need to Refinance?

- By Jim Blackburn

- on

- purchase, real estate investing, vision board, wealth plan

Let’s be real — paperwork is the part nobody loves.

But here’s the good news: it’s easier than you think.

And with Stairway, you’ll never feel like you’re doing it alone.

We’ll walk you through every step and tell you exactly what’s needed — no guessing, no overwhelm.

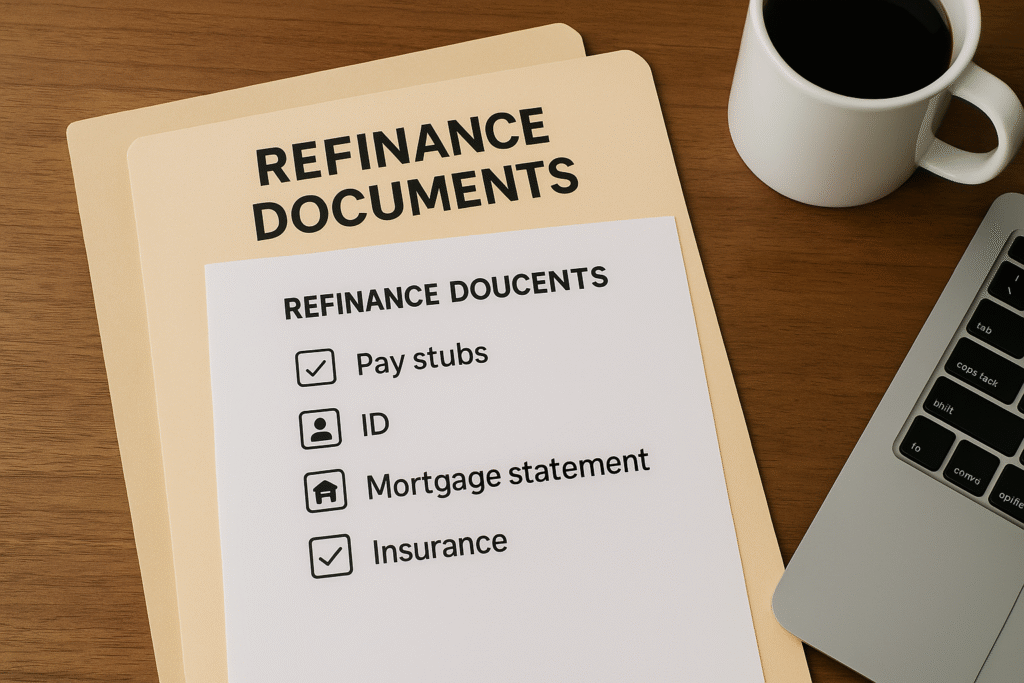

The 5 Essentials You’ll Almost Always Need

Here’s what most lenders (including us) will ask for:

- Income Verification

To show how much you earn, you’ll typically need:

- Last 2 years of W-2s (or 1099s if self-employed)

- Recent pay stubs (usually 30 days)

- Tax returns (especially if you’re self-employed)

- Asset Statements

To show where your funds are coming from:

- Bank statements (typically 2 months)

- Retirement or investment account statements if applicable

- Mortgage Statement

Your most recent one — we use this to compare your current loan with the new options.

- Homeowner’s Insurance

We’ll need proof you have it. If we can help lower your premium, we’ll connect you to our insurance partners.

- Identification

A government-issued ID like a driver’s license or passport.

Bonus: Documents That Might Help or Be Requested

Depending on your situation, we may also ask for:

- HOA statements (if you’re in a condo/townhome)

- Divorce decree or child support info (if relevant to income/debt)

- Business license or P&L (for self-employed borrowers)

Worried About Missing Something? Don’t Be.

We’ll tell you exactly what to upload, and you can do it all digitally — right from your phone or computer.

No printing. No faxing. No guesswork.

4. Transparency That Builds Trust

With us, you’ll never wonder:

- “Am I getting the best deal available?”

- “What are they not telling me?”

- “What surprise fee will show up at closing?”

Our commitment: Clarity, honesty, and education every step of the way.

Bottom Line

You don’t need to have everything figured out — you just need to take the first step.

We’ll guide you from there.

The paperwork is part of the process, but it doesn’t have to be a pain.

With us, it’s streamlined, stress-free, and smarter.

Let’s build wisely. Your stairway starts here.

Ready to Take Your First Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Let’s talk it through. Book a call and one of our friendly advisors will be in touch to guide you personally.

Schedule a CallRecent Post

Passive Investment Return & Tax Advantage Calculator

Heloc Loan Payment Calculator

College Housing Costs VS. Investment Property

Build To Sell Spec Home Calculator: Acquire & Build

1031 Exchange, Capital Gains Tax Savings & Purchase Calculator

VA Renovation Refinance Loan Calculator

VA Renovation Purchase Loan Calculator