The 3 Most Common Mortgage Myths (and Truths)

- By Jim Blackburn

- on

- purchase, real estate investing, vision board, wealth plan

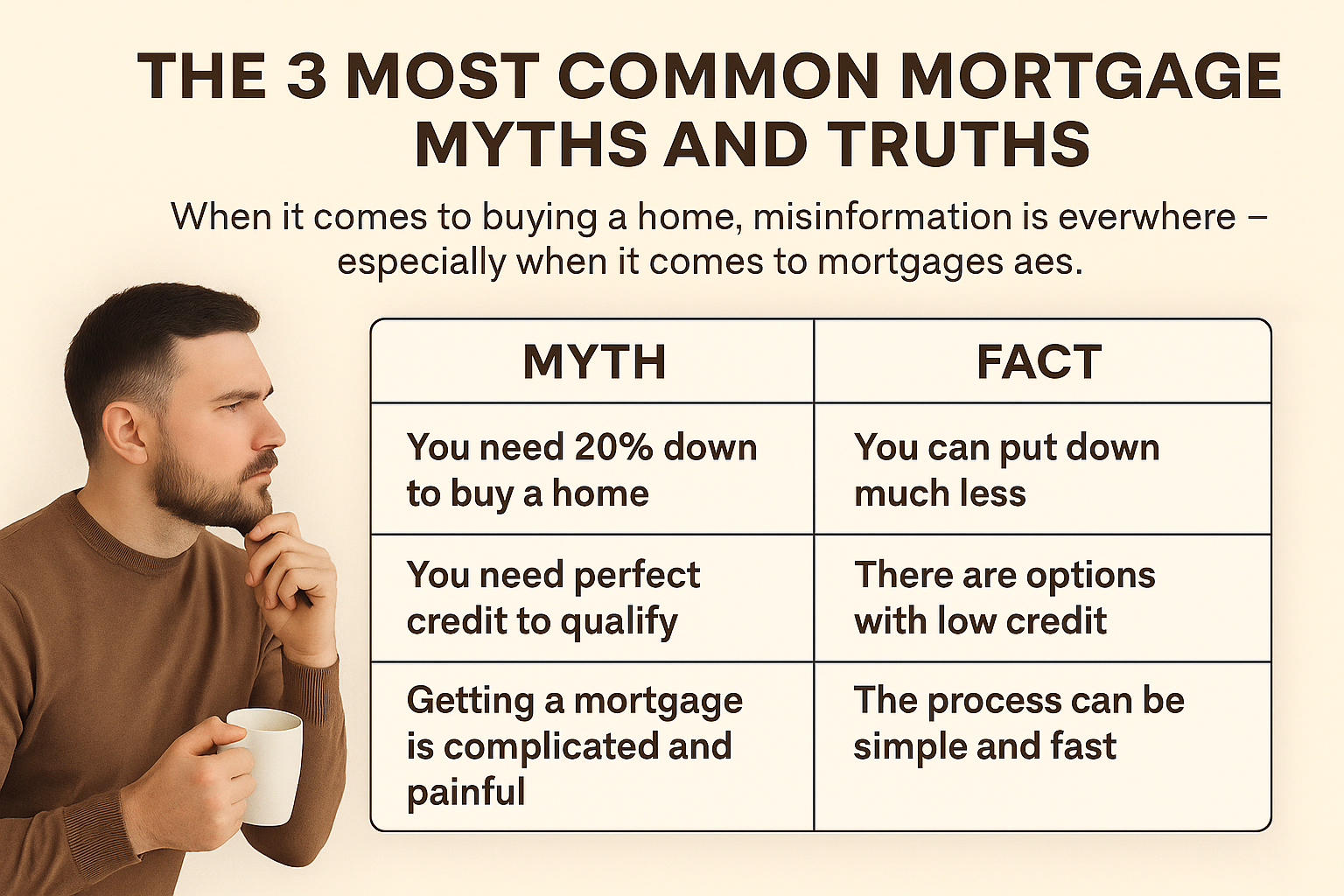

When it comes to buying a home, misinformation is everywhere — especially when it comes to mortgages.

Some of it comes from well-meaning friends.

Some from outdated advice.

And some… is just plain wrong.

Let’s clear the air.

Here are the three most common mortgage myths that hold people back — and the truth behind each one.

Myth #1: You Need 20% Down to Buy a Home

Truth:

That was the rule… in 1960.

Today, most homebuyers put down far less.

In fact, the average down payment for first-time buyers in the U.S. is around 6–7%.

Here are just a few options available:

- 3.5% down FHA loans

- 0% down VA and USDA loans

- 3–5% down conventional loans with no PMI (for qualified borrowers)

And yes — you can still get competitive rates and terms.

Myth #2: You Need Perfect Credit to Qualify

Truth:

You don’t need a perfect score — or even a great one.

We’ve helped people buy homes with credit scores as low as 580.

Lenders look at:

- Your full credit history

- Income and debt-to-income ratio

- Stability of your job and finances

Even with “fair” credit, there are loan options that may work — especially with guidance and planning.

Myth #3: Getting a Mortgage Is Complicated and Painful

Truth:

Not with us.

Yes, buying a home is a big deal. But we’ve spent years streamlining our process, using technology + real people to make it simple and fast.

Here’s how it works:

- You apply online or with our team

- We guide you through docs and next steps

- You get preapproved fast — often same day

We stay in communication every step, and we never leave you guessing.

Bottom Line: Don’t Let Myths Delay Your Goals

The rules have changed.

You may be more ready than you think.

Want to see what you qualify for — without the myths getting in the way?

Ready to Take Your First Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Let’s talk it through. Book a call and one of our friendly advisors will be in touch to guide you personally.

Schedule a CallRecent Post

Passive Investment Return & Tax Advantage Calculator

Heloc Loan Payment Calculator

College Housing Costs VS. Investment Property

Build To Sell Spec Home Calculator: Acquire & Build

1031 Exchange, Capital Gains Tax Savings & Purchase Calculator

VA Renovation Refinance Loan Calculator

VA Renovation Purchase Loan Calculator