The Truth About Credit Scores & Mortgage Approval

- By Jim Blackburn

- on

- purchase, real estate investing, vision board, wealth plan

You’ve probably heard it a hundred times:

“You need a great credit score to get a mortgage.”

But what exactly is a “great” score?

How much does it really affect your approval — or your interest rate?

And what if your score isn’t perfect?

Let’s clear up the confusion and give you the truth about how credit scores work in mortgage lending.

What Lenders Actually Look For

Mortgage lenders use your FICO credit score to help assess your likelihood of repaying a loan.

But they don’t look at just one score — they usually look at three (from Equifax, Experian, and TransUnion) and take the middle one.

Here’s a general breakdown:

Score Range | Impact on Approval |

760+ | Best rates & terms |

700–759 | Very good |

660–699 | Still qualify, slightly higher rates |

620–659 | May need compensating factors |

Below 620 | Possible with FHA or subprime lenders |

The truth? You don’t need “excellent” credit to get approved — but better credit usually means better terms.

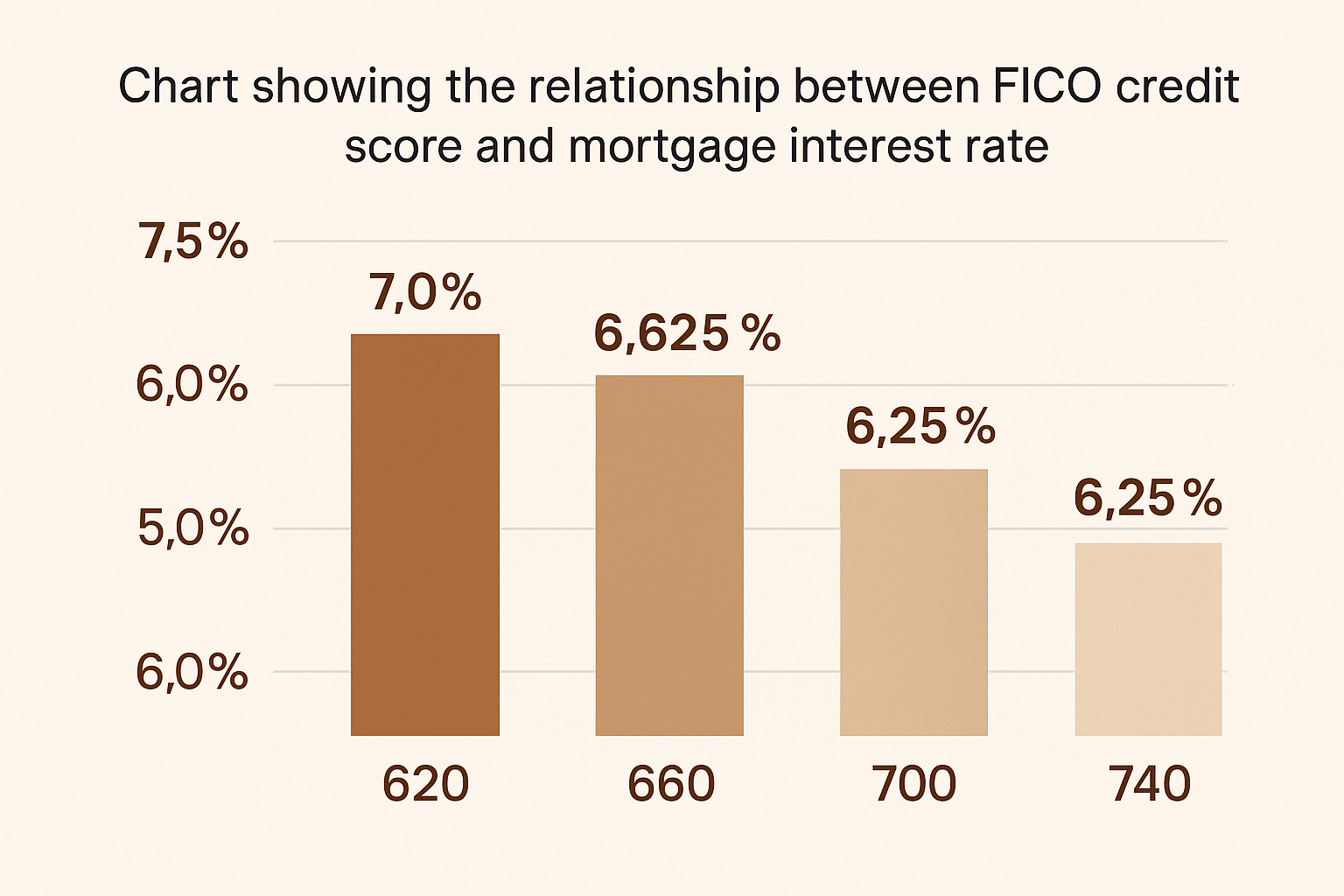

How Credit Affects Your Interest Rate

Lenders price risk into your interest rate. That means:

- A higher score = lower interest rate

- Lower score = higher rate or more conditions

But even if your score is lower, that doesn’t mean you’re stuck.

A skilled mortgage advisor can help you:

- Use non-traditional loan programs (FHA, VA, bank statement)

- Add compensating factors like low debt or strong income

Strategically boost your score in 30–60 days

What NOT to Do Before Applying

Even people with good scores can accidentally hurt their approval chances. Avoid these common mistakes before or during the mortgage process:

- Don’t open new credit cards

- Don’t buy a car or take on new debt

- Don’t make large transfers or deposits without documentation

- Don’t close old accounts or make big balance shifts

Always talk to your mortgage advisor before making any major financial moves.

What If My Score Isn’t Great?

That’s what we’re here for.

We’ve helped people with 580 credit scores become homeowners, and we’ve helped 800-score clients save six figures in interest.

It’s not just about the number. It’s about the strategy.

Bottom Line: Your Score Is Just One Part of the Puzzle

We look at the whole picture — income, assets, debt, goals — and we build a mortgage plan that works for you.

Whether you’re buying your first home or building your tenth, we’ll help you use your credit to your advantage.

Ready to Take Your First Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Let’s talk it through. Book a call and one of our friendly advisors will be in touch to guide you personally.

Schedule a CallRecent Post

Passive Investment Return & Tax Advantage Calculator

Heloc Loan Payment Calculator

College Housing Costs VS. Investment Property

Build To Sell Spec Home Calculator: Acquire & Build

1031 Exchange, Capital Gains Tax Savings & Purchase Calculator

VA Renovation Refinance Loan Calculator

VA Renovation Purchase Loan Calculator