How Much Can You Actually Get from a Reverse Mortgage?

- By Jim Blackburn

- on

- reverse mortgage

You’ve built equity in your home — now you’re wondering what it’s actually worth to you.

With a reverse mortgage, you can convert a portion of that equity into tax-free cash. But how much can you access? And what affects the final number?

Let’s break it down.

There’s No One-Size-Fits-All Number

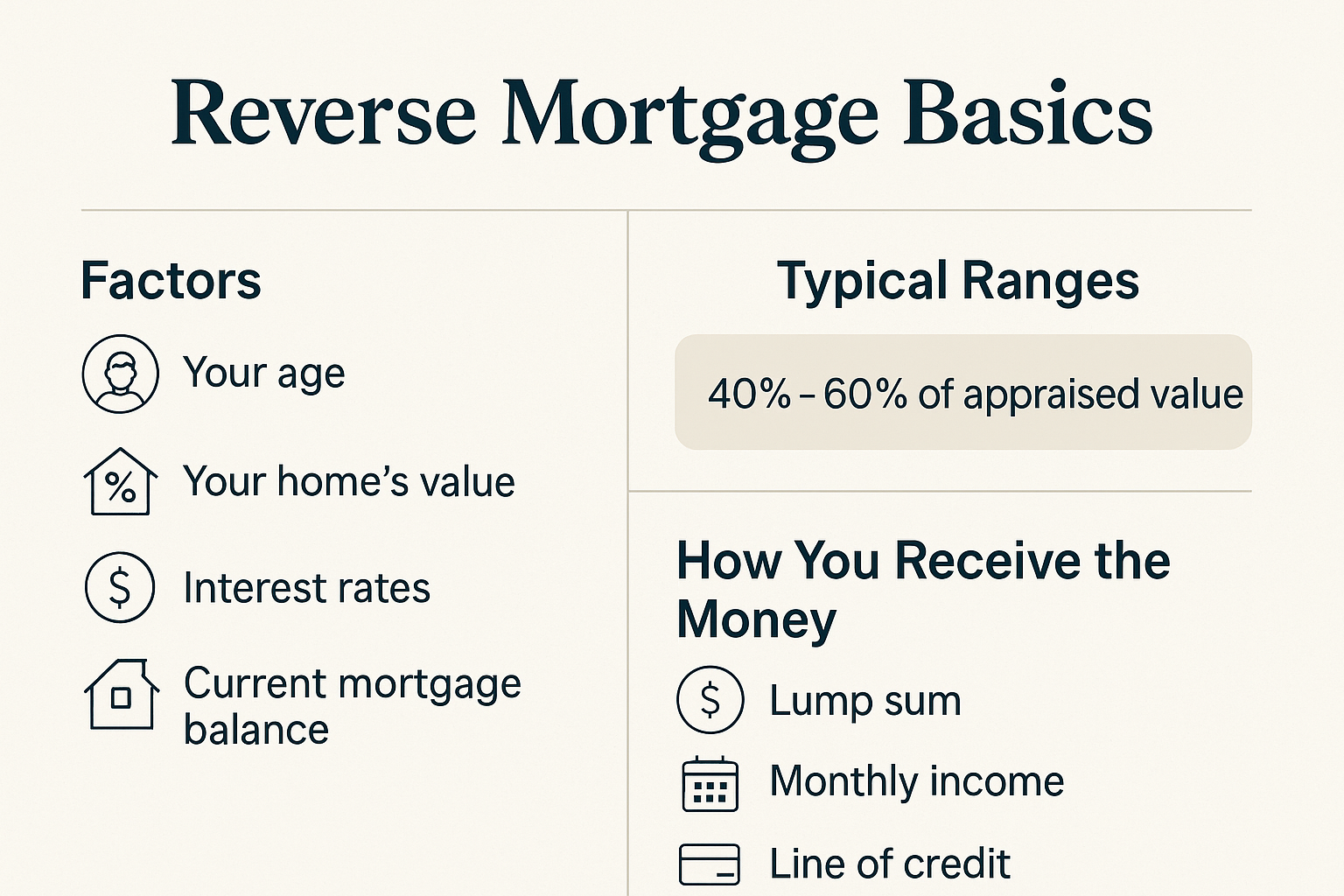

The amount you can borrow through a reverse mortgage depends on a few key factors:

- Your age (or the youngest borrower, if married)

- Your home’s current market value

- Current interest rates

- Remaining balance on your current mortgage

- Loan program options (fixed vs. line of credit)

The older you are, and the more equity you have, the more money you may qualify to receive.

Typical Ranges

While exact numbers vary, many borrowers can access between 40–60% of their home’s appraised value.

For example:

Scenario | Estimated Available Amount |

Age 62, $400,000 home | $160,000–$200,000 |

Age 75, $500,000 home | $225,000–$275,000 |

Age 82, $650,000 home | $300,000–$375,000 |

Note: These are estimates. A personalized quote will be based on your actual numbers.

How You Receive the Money

You can choose how your funds are disbursed:

- Lump sum (good for paying off an existing mortgage)

- Monthly income (great for supplementing retirement cash flow)

- Line of credit (only use what you need, when you need it)

- Or a combination of the above

One big benefit? No required monthly payments.

The loan is repaid when you move out, sell, or pass away — typically through the sale of the home.

What About Fees and Payoffs?

If you still have a mortgage, part of your reverse mortgage funds will go toward paying off that balance first. After that, any remaining funds are yours to use.

Typical closing costs include:

- FHA insurance

- Appraisal

- Title & escrow

- Loan origination

These can often be rolled into the loan, so you don’t need cash upfront.

Want to Know Your Number?

We’ll run a custom reverse mortgage quote based on:

- Your home’s current value

- Your exact age

- Your current mortgage (if any)

- The best program fit for your situation

No pressure. No credit pull. Just real insight.

Final Thought

You don’t need to sell your home to access your equity.

A reverse mortgage can help you turn your home into a source of income, security, or opportunity — while staying right where you are.

Let’s build wisely. Your stairway starts here.

Ready to Take Your First Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Let’s talk it through. Book a call and one of our friendly advisors will be in touch to guide you personally.

Schedule a Call