How Mortgage Leverage Builds Wealth

- By Jim Blackburn

- on

- purchase, real estate investing, vision board, wealth plan

For most Americans, a mortgage isn’t just a way to buy a home — it’s the most powerful financial tool they’ll ever use.

But here’s what most people never realize:

The wealth is in the leverage.

When used wisely, a mortgage gives you access to something far more valuable than a house — it gives you ownership, equity growth, and scalable wealth potential that renting can never provide.

Let’s break it down.

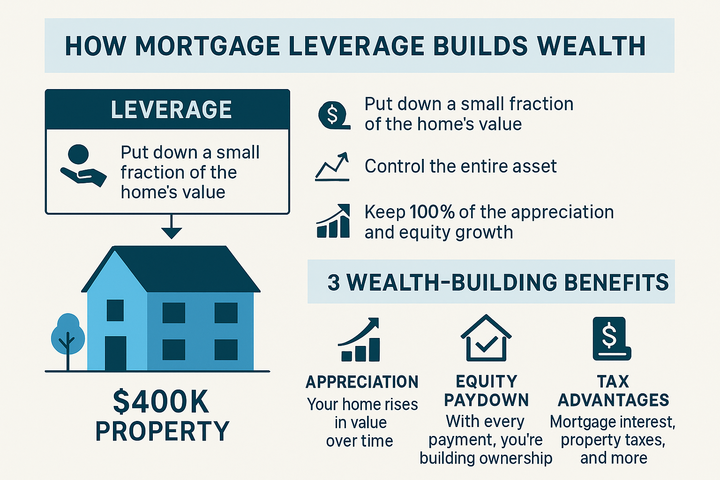

What Is Leverage in Real Estate?

In simple terms, leverage means using other people’s money to control an asset that grows in value.

When you take out a mortgage, you’re using the bank’s capital (usually 75–97% of the purchase price) to own 100% of the property.

You:

- Put down a small fraction of the home’s value

- Control the entire asset

- Keep 100% of the appreciation and equity growth

That’s leverage.

Example: $400K Property, 5% Down

- Your down payment: $20,000

- Loan amount (mortgage): $380,000

- Home appreciates 5% in Year 1: New value = $420,000

You just gained $20,000 in equity — a 100% return on your down payment — even though you only “owned” 5% of the property at the start.

Now imagine that over 5–10 years, with debt being paid down and the home continuing to grow in value.

Why This Beats Saving Alone

If you save $20,000 in a bank account, it might grow at 3–5% annually.

In real estate, $20K can control a $400K asset — and that asset can grow in value, generate tax advantages, and eventually become income-producing.

That’s the beauty of mortgage leverage:

You can grow wealth faster without having to save hundreds of thousands first.

3 Wealth-Building Benefits of a Mortgage

- Appreciation

Your home rises in value over time — and you keep all the upside. - Equity Paydown

With every payment, you’re building ownership — not just covering rent. - Tax Advantages

Mortgage interest, property taxes, and even depreciation (on rentals) can reduce your taxable income.

Bonus: When you refinance or use a HELOC, you can tap into equity without selling.

But Only If You Use It Wisely…

Leverage can also magnify losses if used recklessly.

So we always ask:

- Is your payment sustainable long-term?

- Are you buying in a smart location?

- Is this step part of a bigger plan?

We help you answer those questions — and use leverage as a launchpad, not a trap.

Takeaway: Your Mortgage Is a Tool, Not a Debt Sentence

It’s time to stop seeing a mortgage as “just a loan” and start seeing it as the most affordable path to scalable wealth.

Whether you’re buying your first home or planning your third rental, leverage — done right — is the game changer.

Ready to Take Your First Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Let’s talk it through. Book a call and one of our friendly advisors will be in touch to guide you personally.

Schedule a CallRecent Post

Passive Investment Return & Tax Advantage Calculator

Heloc Loan Payment Calculator

College Housing Costs VS. Investment Property

Build To Sell Spec Home Calculator: Acquire & Build

1031 Exchange, Capital Gains Tax Savings & Purchase Calculator

VA Renovation Refinance Loan Calculator

VA Renovation Purchase Loan Calculator