Buying Your First Investment Property — House Hack or Duplex?

- By Jim Blackburn

- on

- purchase, real estate investing, vision board, wealth plan

Let’s get this out of the way right now:

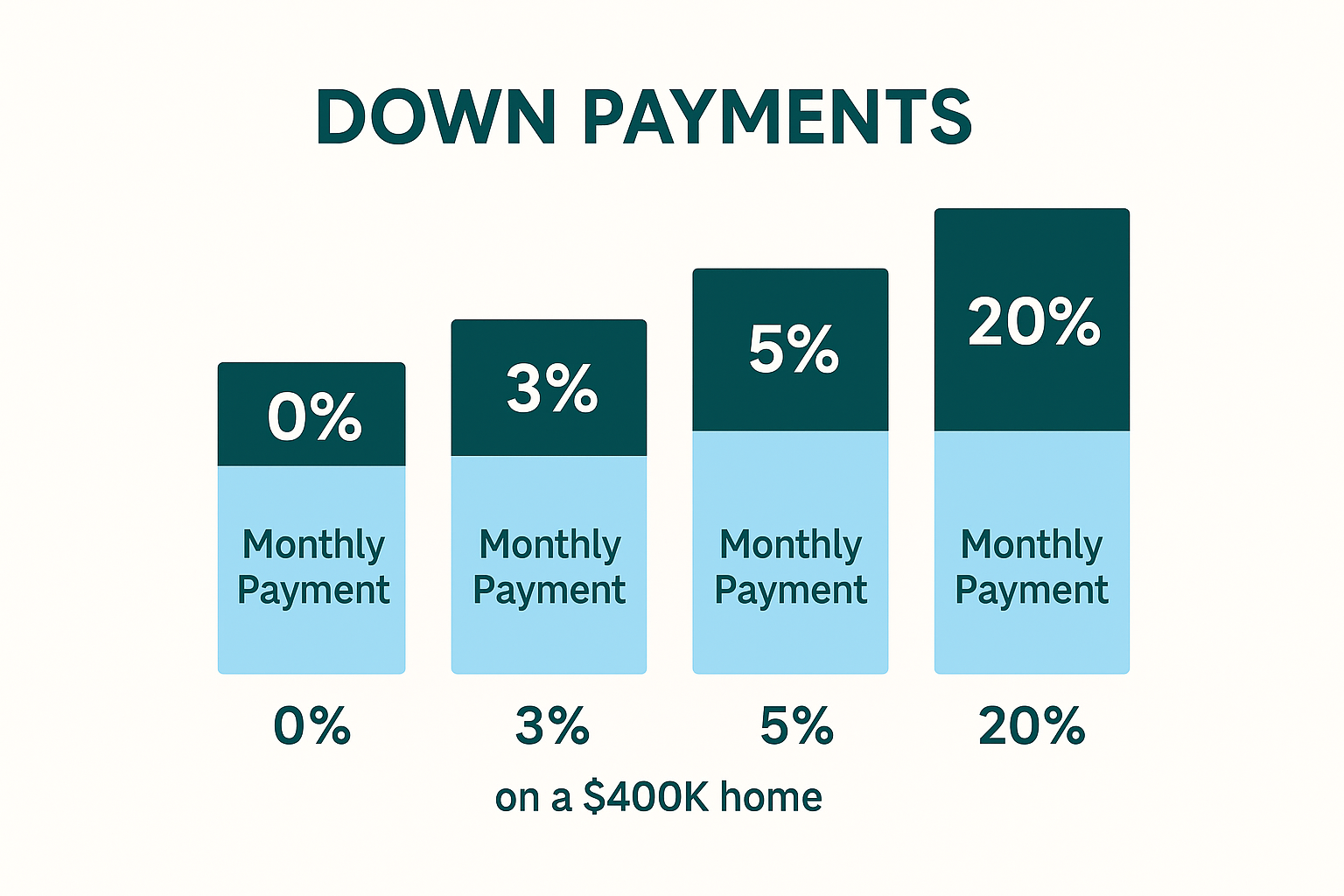

You do NOT need 20% down to buy a home.

You can put 20% down if it fits your goals…

But you don’t have to.

And for many people — especially first-time buyers — it might even slow you down unnecessarily.

Let’s unpack what’s really going on with down payments — and which option might fit your strategy.

0% Down: For Qualified VA or USDA Borrowers

Yes, you can still buy a home with zero down — if you qualify.

VA Loans (Veterans):

- 0% down for active-duty, veterans, and some reservists

- No PMI

- Competitive rates backed by the VA

USDA Loans (Rural areas):

- 0% down for homes in eligible areas

- Income limits apply

- Great for smaller towns or rural counties

Best for:

- Veterans, active military, rural buyers

Those with good credit and stable income but low cash reserves

3–5% Down: The Modern Norm

Most first-time buyers today use 3–5% down options through conventional or FHA loans.

- 3% down: For first-time buyers with good credit

- 3.5% down FHA: For those with credit scores as low as 580

- 5% down: Standard minimum for repeat buyers

Yes, you may have to pay PMI (private mortgage insurance), but with the right program, it’s manageable — and sometimes waived altogether.

Best for:

- Buyers with limited savings

- Renters ready to own sooner rather than later

20% Down: Pros, Cons, and Misconceptions

Yes, 20% down helps you avoid PMI — and lowers your monthly payment.

But that doesn’t mean it’s always the best choice.

Pros:

- No PMI

- Lower payment

- Easier approval with some lenders

Cons:

- Ties up your cash

- Can delay buying by years

- May not generate the best return on investment (ROI)

Sometimes, putting less down and investing the rest elsewhere may actually grow your wealth faster.

So… How Much Should YOU Put Down?

It depends on:

- Your current savings

- Your monthly comfort zone

- Whether this is your forever home or a stepping stone

- Your investment goals

Let’s create a plan that balances today’s opportunity with tomorrow’s flexibility.

Ready to Take Your First Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Let’s talk it through. Book a call and one of our friendly advisors will be in touch to guide you personally.

Schedule a CallRecent Post

Passive Investment Return & Tax Advantage Calculator

Heloc Loan Payment Calculator

College Housing Costs VS. Investment Property

Build To Sell Spec Home Calculator: Acquire & Build

1031 Exchange, Capital Gains Tax Savings & Purchase Calculator

VA Renovation Refinance Loan Calculator

VA Renovation Purchase Loan Calculator