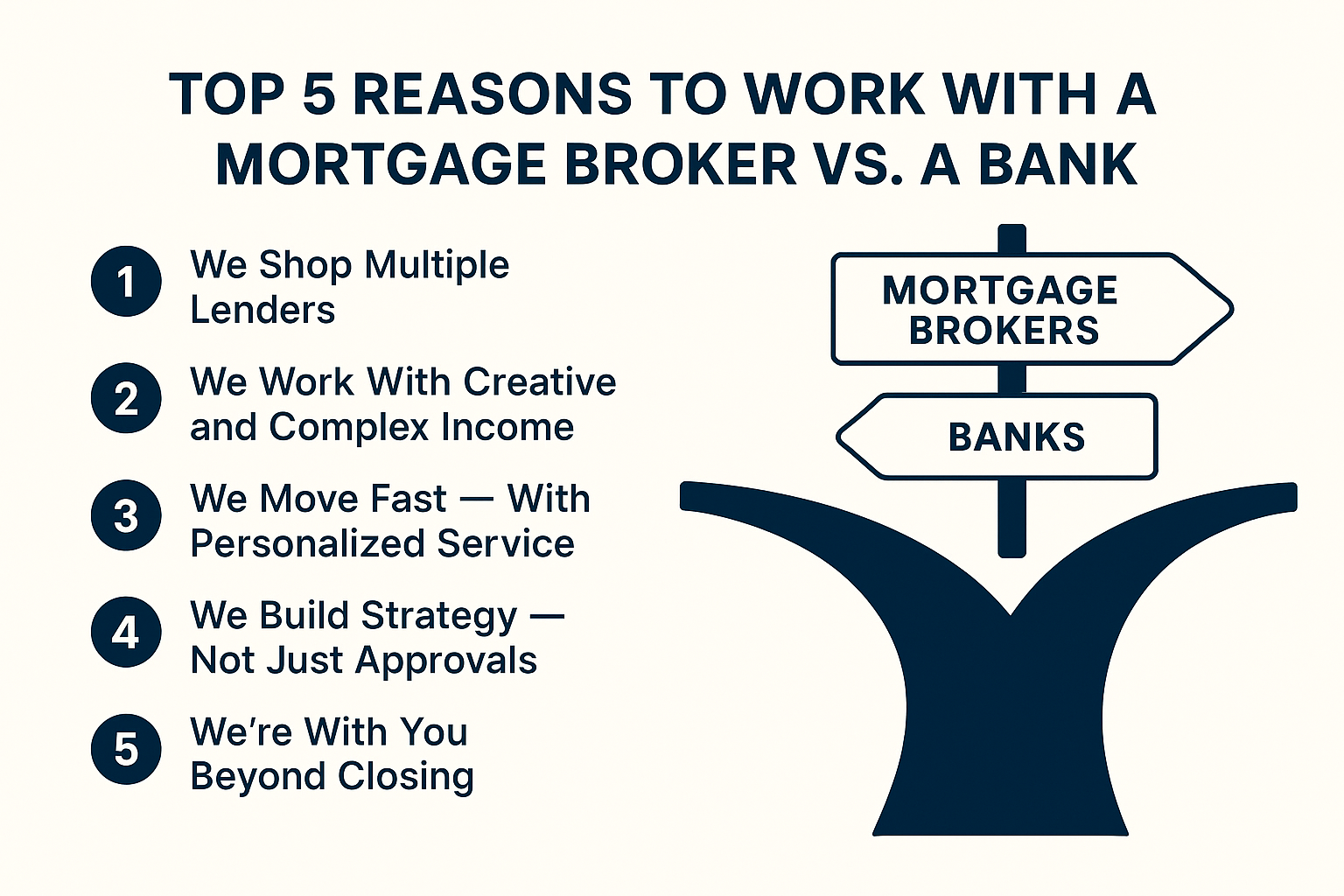

Top 5 Reasons to Work With a Mortgage Broker vs. a Bank

- By Jim Blackburn

- on

- financial advice, mortgage broker, mortgage lender, purchase

When you’re shopping for a home loan, most people start with their local bank or credit union. But here’s the truth:

Your bank only has one offer.

A mortgage broker has dozens — and our job is to fight for you, not the lender.

At Stairway Mortgage, we believe educated clients make empowered decisions. So let’s break down why more homebuyers and investors are choosing to work with brokers like us — and why it could save you time, money, and a lot of stress.

1. We Shop Multiple Lenders — You Get the Best Deal

Banks offer you one product: their own.

As brokers, we compare rates and programs across 30+ lenders to match you with the best option for your unique goals — whether that’s lowest payment, fastest approval, or most flexibility.

Result: You win. Every time.

2. We Work With Creative and Complex Income

If you’re self-employed, earn commission, receive 1099 income, or own multiple businesses, most banks will either say “no” or ask you for piles of unnecessary documentation.

At Stairway, we’re experts in nontraditional income structures. We work with lenders who specialize in bank statement loans, DSCR programs, asset-based lending, and more.

3. We Move Fast — With Personalized Service

Big banks have red tape. Call centers. Processing delays. Underwriting departments in a different city. You know the drill.

With Stairway, you get a direct line to your loan officer. We move with urgency — and treat your file like it matters. Because it does.

4. We Build Strategy — Not Just Approvals

Anyone can “get you a loan.” We design wealth-building plans.

We advise you on how to:

• Use mortgage leverage for long-term gain

• Time your refinance or equity moves

• Optimize your rate and loan term for wealth acceleration

This isn’t just a transaction — it’s part of your future.

5. We’re With You Beyond Closing

After the loan closes, we don’t disappear. We continue to advise on future investments, rate monitoring, HELOC options, and refinancing opportunities.

Think of us as your long-term financial teammate — not just a one-time provider.

Ready to Take Your First Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Let’s talk it through. Book a call and one of our friendly advisors will be in touch to guide you personally.

Schedule a CallRecent Post

Passive Investment Return & Tax Advantage Calculator

Heloc Loan Payment Calculator

College Housing Costs VS. Investment Property

Build To Sell Spec Home Calculator: Acquire & Build

1031 Exchange, Capital Gains Tax Savings & Purchase Calculator

VA Renovation Refinance Loan Calculator

VA Renovation Purchase Loan Calculator