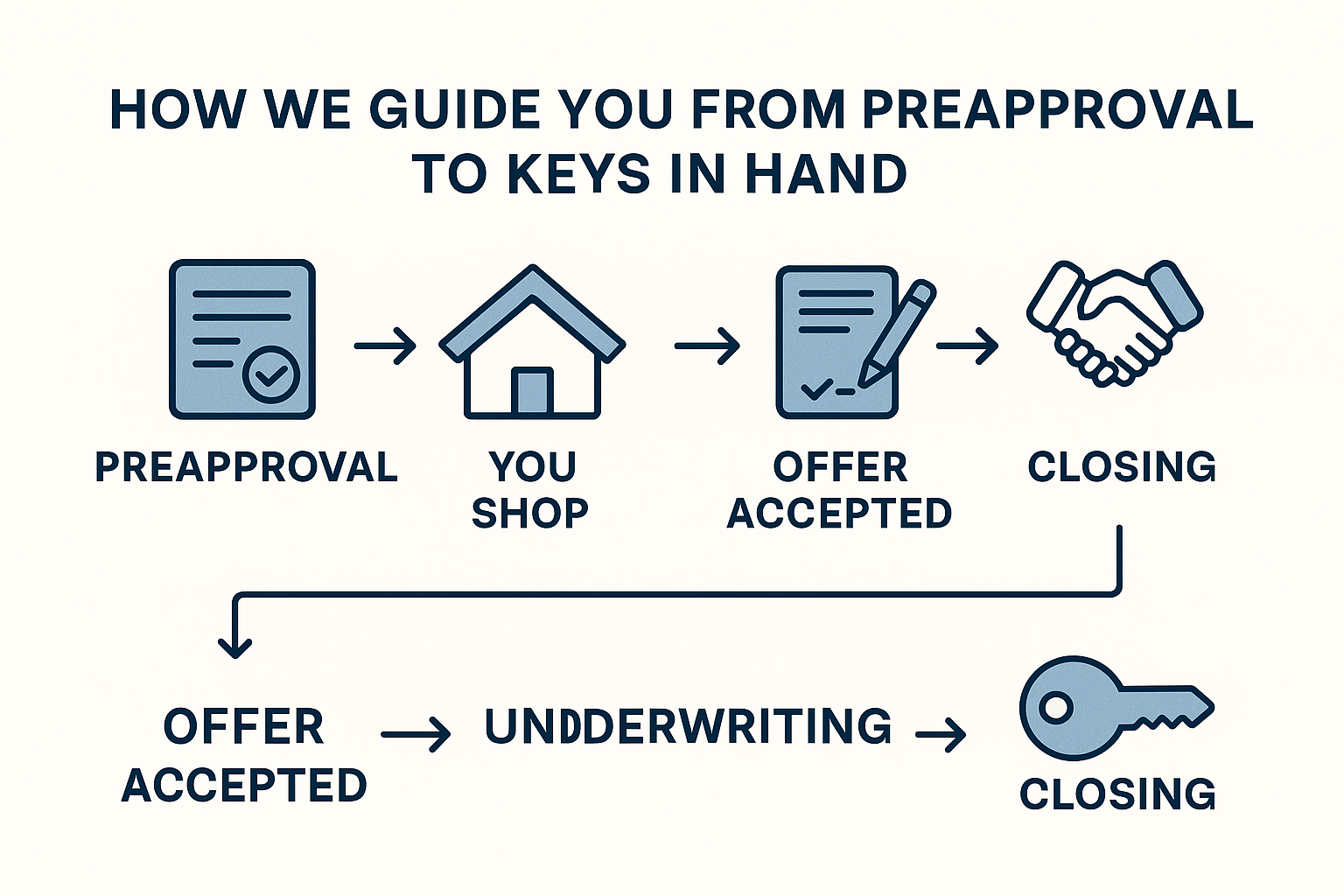

How We Guide You From Preapproval to Keys in Hand

- By Jim Blackburn

- on

- first time home buyer, mortgage process, purchase

Getting preapproved is a powerful first step — but what happens after that?

At Stairway Mortgage, we don’t just help you get approved. We walk with you, every step, until you’re holding the keys to your new home — and even beyond.

Here’s what the journey looks like once your preapproval is in hand.

1. Preapproval: Your Power Tool

When you’re preapproved by Stairway, you’re equipped with more than just a letter — you’re backed by strategy.

- We calculate a realistic budget based on your goals.

- We coach you on how to make winning offers.

- We show you how to position your loan to appeal to sellers.

This isn’t guesswork. It’s intentional guidance to help you stand out in a competitive market.

2. You Shop, We Advise

As you begin looking at homes, we’re still in the background running scenarios.

- Found a home with HOA fees? We’ll re-calculate your monthly.

- Thinking of offering above asking? We’ll stress test your budget.

- Need to tweak your down payment? We’ll reconfigure the numbers.

We help you avoid surprises so you can shop with confidence.

3. Offer Accepted — We Go to Work

Once your offer is accepted, we immediately kick off the next steps:

- Lock in your rate (if you haven’t already)

- Order the appraisal

- Begin underwriting and request supporting docs

- Work closely with your realtor and title company to align all moving parts

Our processors and loan team will communicate clearly and regularly. No guesswork. No silence.

4. Underwriting + Docs Made Easy

This is the part where other lenders lose momentum. Not us.

- We help you organize documents in advance

- We respond to underwriter conditions swiftly

- We get you clear to close with time to spare

You’ll always know where you are in the process and what to expect next.

5. Closing Day — and Beyond

We’ll confirm every detail, help you review your closing disclosure, and celebrate with you when you sign that last page.

But we’re not done there.

- We’ll check in after you move in

- Monitor market conditions for future refinancing

- Help with future property purchases or investments

You’re a part of the Stairway family now — and that relationship doesn’t end with the transaction.

Ready to Take Your First Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Let’s talk it through. Book a call and one of our friendly advisors will be in touch to guide you personally.

Schedule a CallRecent Post

Passive Investment Return & Tax Advantage Calculator

Heloc Loan Payment Calculator

College Housing Costs VS. Investment Property

Build To Sell Spec Home Calculator: Acquire & Build

1031 Exchange, Capital Gains Tax Savings & Purchase Calculator

VA Renovation Refinance Loan Calculator

VA Renovation Purchase Loan Calculator