Single Family vs Multi Family Home: Which Is Best for You?

- By Jim Blackburn

- on

- FHA, Multi-Family, Real Estate Investor, Single-Family Home, Wealth Building

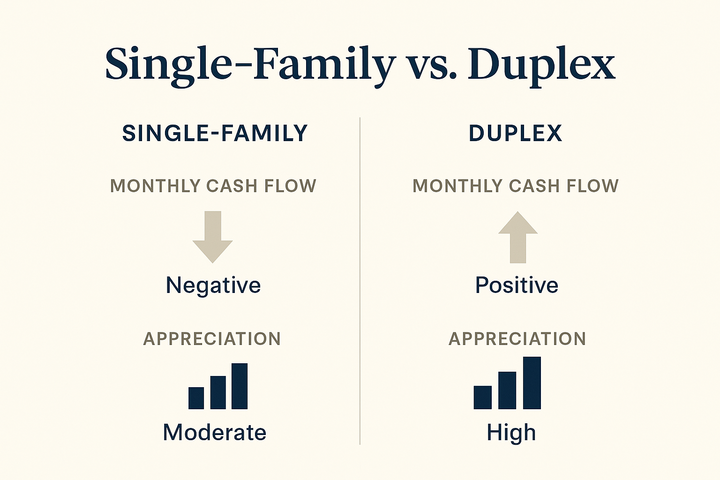

Whether you’re buying your first home or your first investment property, one of the biggest decisions is this:

Do you go single-family… or multi-family?

Each path has pros and cons, and the right choice depends on your lifestyle, your goals, and your long-term wealth plan.

Let’s break down the key differences so you can decide which one fits your next move.

What Counts as a Multi-Family Property?

- 2–4 units (duplex, triplex, fourplex)

- Still qualifies for residential financing (NOT commercial)

- You can live in one unit and rent the others

- Often available with FHA or 5% down conventional loans

In short: you can house hack and become a landlord — all while living there.

Explore how multi-family house hacking works with our FHA 2–4 Unit Home Purchase calculator to see how you can buy with just 3.5% down and have tenants help pay your mortgage.

Single-Family Homes: Pros & Cons

Pros:

- Often easier to find

- Simpler to finance, insure, and manage

- Easier resale and broader buyer pool

- More privacy and autonomy as a homeowner

Cons:

- No built-in rental income

- Higher financial burden (you cover 100% of mortgage)

- Limited scalability (you can only live in one house at a time)

If single-family is your choice, use our Conventional Purchase Loan or FHA Purchase Loan calculator to understand your monthly payments and down payment options.

Multi-Family Homes: Pros & Cons

Pros:

- Rental income can offset or cover your mortgage

- Great for first-time investors and house hackers

- More efficient property management over time

- Can jumpstart your portfolio with 2–4 units at once

Cons:

- Slightly higher cost up front

- May require more repairs or tenant management

- Fewer options in some markets

You share walls — and your tenants are your neighbors.

Learn how multi-family investing builds wealth with our Buy and Hold Real Estate calculator, or explore how the BRRRR Method helps you scale from one multi-family property to many.

Questions to Ask Yourself Before Deciding:

- Do I want peace and privacy — or early cash flow and scale?

- Will this be my long-term home — or a stepping stone?

- Am I ready to manage (or hire out) tenants and maintenance?

There’s no wrong answer. But there is a better fit for your goals — and we’ll help you figure out what that is.

Run the numbers on both property types using our loan calculators to compare monthly costs with and without rental income factored in.

So… How Much Should YOU Put Down?

It depends on:

- Your current savings

- Your monthly comfort zone

- Whether this is your forever home or a stepping stone

- Your investment goals

Let’s create a plan that balances today’s opportunity with tomorrow’s flexibility.

Start exploring your options with our first-time buyer resources to understand which property type and financing strategy aligns with your goals.

Want to Choose the Right Property Type for Your Strategy?

Single-family offers simplicity while multi-family offers income—here’s how to decide which path builds your future:

🏘️ Calculate multi-family house hacking with the FHA 2–4 Unit Home Purchase calculator to see how tenants can cover most of your mortgage

🏡 Compare single-family financing with our Conventional Purchase Loan or FHA Purchase Loan calculators

📊 Learn how Buy and Hold Real Estate creates long-term wealth through cash flow and equity growth

🔄 Explore the BRRRR Method to see how multi-family properties can become your first step toward a real estate portfolio

Ready to Take Your First Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Let’s talk it through. Book a call and one of our friendly advisors will be in touch to guide you personally.

Schedule a Call